The Verge‘s Jordan Golson believes that the success of the Gigafactory is the most critical part of Tesla Motors Inc (NASDAQ:TSLA) future. The plant, which would produce enough battery packs to power 500,000 electric cars a year, is absolutely essential for what is expected to be high demand for Tesla’s Model 3, the company’s $35K BMW 3-series competitor it hopes to launch by 2017.

By year FY 2020 Tesla plans to ramp up production to build as many as half a million vehicles per year, an ambitious goal considering the Palo Alto, California-based company currently only produces about 50K electric cars a year. In other words, without the Gigafactory, there simply won’t be a Model 3 because there will be no batteries. To say the success of Gigafactory is the most important challenge facing Musk, who has staked his entire company and much of his net worth on the project, is hardly an overstatement.

The giant plant, which will be big enough to cover around 107 NFL football fields with two to four floors of factory floor and workspace layered on top, shows the scale of Musk’s ambition. When Panasonic Corp. executive vice president Yoshihiko Yamada was first introduced to the idea of Tesla’s battery plant three years ago, he said, “I thought it was crazy.”

Crazy, because “the production capacity of this factory would exceed the global capacity of the industry,” Yamada said.

Despite the skepticism, Panasonic agreed to invested $1.6 billion in Elon Musk’s battery plant outside Reno. It wasn’t until this spring when 373,000 people put down the $1,000 deposit required for Tesla’s Model 3 that Yamada realized there is strong demand for the electric cars and the batteries that power them — and things didn’t look crazy anymore.

That sort of demand “surprised even us”, Elon Musk was quoted as saying in late April to a conference crowd in Oslo, Norway.

Although Musk projects a confident air of a CEO poised to disrupt the fossil fuel industry, the real debate among investors is about the company’s production goals, its profitability, and where its stock is headed. The reality is that Tesla has been spending its funds at an alarming rate by investing billions of dollars to expand production capacity. The Model 3 is expected to increase the company’s capex this year by $750 million alone. This compares with a t-12 period of about $643 million in negative operating cash flow. Furthermore, some analysts see current spending levels as unsustainable without the company being forced to tap the equity markets.

“With its ambitious plans that will require an incremental fundraising, we view Tesla as more of a cash-hungry startup unicorn than a traditional public company,” Barclays’ Brian Johnson wrote in a research note recently. “With Tesla likely to come to the market for a capital raise near-term, it’s worth asking whether it deserves an up round or a down round.”

Johnson has a point. If a fresh round of financing takes place and for some reason the stock starts to plummet and margin calls go out on the basis of borrowed funds, Tesla’s stock price would basically nose dive. So the question is, will Tesla be a stock worth holding or a risk that doesn’t pay off for investors?

Before answering that question, there are a few metrics to consider that may help navigate the stock’s price reaction depending on news. First of all, the company is set to announce its Q216 earnings after the market close on Wednesday, August 3. Analysts expect the electric car maker to report an EPS loss of $0.51 and revenue of $1.67 billion. That would be $0.06 higher the ($0.57) per share posted last quarter, but $0.03 lower the ($0.48) posted in the 2Q15. Revenue is projected to be $715 million higher than the $955 million posted in the same period a year earlier. In the meantime, EarningsWhisper.com reports a whisper number of ($0.56) per share.

Beyond Tesla’s reported revenue and EPS, other important areas to watch will be any updates on the company’s Model 3 program as well as guidance for Q3 vehicle deliveries. As already mentioned above, Tesla Model 3 pre-orders have reached 373,000 — more than 7x Tesla’s total vehicle deliveries last year. To be exact, in fiscal-year 2015, the company delivered 50,580 vehicles for a net loss of $800 million. Keep in mind, so far this year, Tesla has delivered only 29,190 vehicles from an expected total of 50K vehicles. So, again, guidance for Q3 vehicle deliveries and the company’s execution pace on its audacious growth targets should be another focusing area for investors.

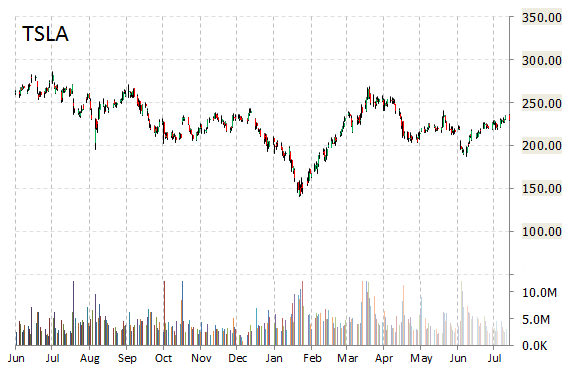

Tesla Stock Price

Tesla’s stock price reaction to earnings tends to be somewhat extreme given the issue’s float dynamics. As we all know, the name has been a technical powerhouse for quite some time, advancing more than 1,000% to $279 and change since its initial public offering in 2010. Still, there is a large percentage of the float that is short at over 32% as of the 7/15/2016 settlement date. So the near-term potential for a major short-squeeze, or crushing of the stock below the $210 level following earnings are both plausible scenarios.

That said however, and despite the fact Tesla bulls continue to sustain the stock, the reality is that at least for the time being, Tesla – a company facing a myriad of problems, including high production costs, the impossibility of increasing output tenfold in just four years, a sustained period of low oil prices, and broader market challenges – remains just a car company with an overvalued stock. All these arguments suggest that for the next 12-months the bearish trend favors the odds for TSLA’s next move being to the downside.

Tesla Motors closed at $230.01 on Monday and is currently trading -0.66 percent.

Leave a Reply