After Apple Inc. (NASDAQ:AAPL) turned in better-than-expected Q316 earnings on Wednesday, its shares surged almost 8% during the first trading day after the report to close at a three-month high of $104 and change, confirming what the billionaire Berkshire Hathaway manager Warren Buffett may have believed several months ago, that a bottom is already in place for the stock.

Buffet, who doesn’t own a smartphone and is famous for his lack of investments in the tech sector, purchased through Berkshire (NYSE:BRK.A) (NYSE:BRK.B) 9.8 million shares of Apple on May 16, 2016 worth roughly $1.07 billion.

What’s interesting with the timing of Buffett’s purchase is that well-known investors Carl Icahn and David Tepper had done the opposite at around the same time. Hedge fund billionaire Tepper exited his entire 1.26 million stake in Apple on May 13 and in late April, Icahn said he no longer had any shares in the iPhone maker. Icahn had owned 45.8 million shares as of Dec. 31. At one point, the activist billionaire investor, who predicted the company would be the first to be valued at $1 trillion, owned 53 million Apple shares, or nearly 1% of the company.

In the first quarter of 2016, Apple was the most heavily sold stock. According to reports, in Q1 the top 50 hedge funds dumped more than $7 billion worth of Apple stock, compared with purchases of $2.2 billion in the fourth-quarter of FY 2015.

Investors started dumping Apple shares after the company’s 13-year run of quarterly revenue growth ended. The $561 billion market cap Silicon Valley giant – a casualty of its immense size – saw its first year-on-year sales decline since 2003 and its first-ever drop in iPhone unit sales in the March quarter.

So the question is ; did Apple bottomed after Buffett put his stamp of approval? The answer is, most probably, yes. The fact is, Buffett has a long record of buying when there is blood in the streets. He also tends to buy fundamentally strong companies that he believes are undervalued by the market. In fact, Buffett purchased his stake in Apple last quarter when AAPL was near its 52–week low. Additionally, Apple is the classic Buffett stock given the fact the Oracle of Omaha loves brand name companies with a strong customer base, and there are not many companies out there with a more loyal customer base than Apple.

Wednesday’s Apple rally, its biggest one-day percentage gain since April 24, 2014, came also at a time when some analysts were starting to think the worst is behind the company.

BTIG’s Walter Piecyk reiterated a ‘Buy’ rating on Apple stock after raising the name’s price target to $124 from $115. In a note to investors, Piecyk said [via Barron’s] Cupertino “delivered on FQ3 and gave comfort on FQ4 which will allow investors to focus on what new products (including a new product launch expected this quarter) can potentially return the company to growth.” The analyst noted that he expects the tech giant to return to growth in Q1 2017.

Alongside BTIG, Raymond James analyst Tavis McCourt also issued a research report on Apple stock. McCourt, who turned bullish on AAPL for the first time since ticker peaked 17 months ago, raised his Apple rating to ‘Outperform’ from ‘Market Perform’, with a $129 price target, noting that while he has concerns about Apple, including declining revenue in China, and problems with the iPhone, iPad and Mac business which continue to track below expectations, he thinks it’s time to buy the issue.

It is to be noted that despite the positive ratings and encouraging comments for Apple’s business, investors shouldn’t expect the company to return to growth just yet. Management forecast fourth-quarter revenue to be between $45.5 to $47.5 billion, implying a decline of 7.8% to 11.65% from Apple’s $51.5 billion of revenue in the fourth-quarter of FY 2015. That said however, Apple and its undervalued stock for such a fundamentally solid company, could return to growth during its Q117, which begins October 1.

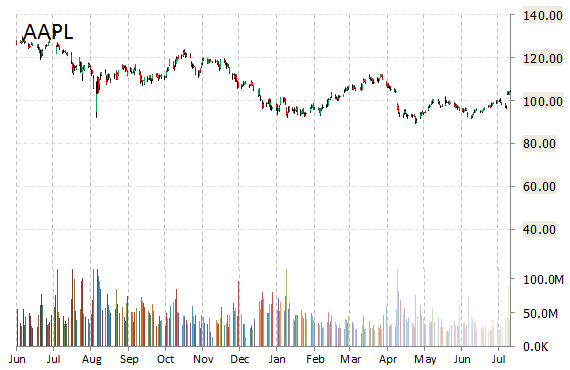

Apple Stock Action

Shares of Apple have lost more than 1 percent of their value since Jan. 1. In the past 52-weeks, the stock has traded between a low of $89.47 and a high of $123.82, with its 50-day MA and 200-day MA located at $97.33 and $99.36 levels, respectively.

On valuation-measures, shares of Apple Inc. have a trailing-12 and forward P/E of 12.15 and 11.71, respectively. P/E to growth ratio is 1.61 while t-12 profit margin is 21.70%. EPS registers at 8.58. The company has a median Street price target of $120 with a high target of $185.

Apple is marginally higher at recent check. The stock remains in the green since dip buyers stepped in at $100 last week. A re-test of Friday’s high of $104.55 could set it in motion for higher prices. The next short term area of interest is at $105.75 followed by the $106 zone.

Leave a Reply