Falling wages are a problem, a sign of a labor market that is out of equilibrium. Falling wages are a solution, they help restore equilibrium in the labor market.

Both statements are defensible, and I think the best way to visualize business cycles is to try to hold both ideas in your mind at the same time. This is from a recent article in The Economist:

In fact, they say, Mr Abe’s campaign may be primarily political. Having nominated a team of tough-talking money-printers as governor and deputy governors of the Bank of Japan, he is determined that the central bank should hit its new 2% inflation target. The problem is, if prices rise but wages don’t, workers will feel the pinch. That would not bode well for an upper-house election in July in which Mr Abe hopes his ruling Liberal Democratic Party will secure a majority in both chambers of parliament.

Hence the pressure applied by Mr Abe and his finance minister, Taro Aso, on big businesses to increase worker compensation. Amid signs of rising consumer sentiment and household spending in January, some have responded positively. Lawson, another convenience-store operator, said higher bonuses this year would boost the annual average pay of a worker with three school-age children by ¥150,000 ($1,600). Other firms, especially exporters benefiting from the falling yen, are likely to agree to union demands for higher bonus payments in annual pay talks this spring.

But Keidanren, the main big-business lobby, has remained cool, saying it wants to see more sustainable profit growth before its members agree to basic-pay increases, which are harder to reverse than bonus payments. Masamichi Adachi of J.P. Morgan says overtime and bonus payments are likely to rise before core salaries do. He says that, rather than higher inflation expectations, the country needs higher growth expectations before companies commit to permanent wage increases. As it is, a planned rise in the consumption tax next year is likely to offset some of the effect of a big fiscal stimulus this year, which means growth may flatten in late 2014.

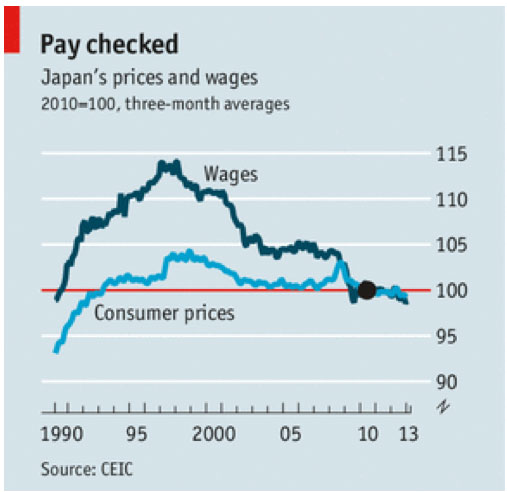

That’s quite an interesting graph. I see three downshifts in nominal wage rates; the after-effects of the 1997 East Asia crisis, the 2001 tech recession, and the global 2008-09 recession. Because nominal wages are sticky, and only some adjust each month, a falling nominal wage rate means (surprisingly) that some other wages are too high. Thus falling nominal wages are often associated with rising unemployment. And I believe that’s true in Japan.

But once wages have fully adjusted, unemployment can go back to the natural rate. On the other hand absolute wage cuts are difficult to make, so the Japanese unemployment rate is probably still a bit above the natural rate. (Note that Japan traditionally has very low unemployment, and some argue that the actual unemployment rate is higher than measured unemployment.)

If Abe’s policy is successful then wages may rise a bit, but it would be a mistake to put the cart before the horse. You’d like wages to rise because of a stronger economy, higher NGDP growth, not because of political pressure. Indeed if wages are forced up artificially that might raise unemployment in Japan.

Also note that Japanese real wages have fallen by about 10% since the 1990s. Japan isn’t doing well, but then neither are the other developed countries (with a few exceptions like Australia and Canada.) Ultimately the key is growth. If monetary stimulus raises RGDP growth, real wages might actually do better than under a tighter monetary policy with lower inflation. Notice that real wages leveled off during the 2002-06 QE program, which temporarily halted the deflation. Once again, it’s not a zero sum game. A bigger pie could mean higher real incomes, at least in the long run—even if inflation rises.

PS. I know that some models predict monetary contraction will raise real wages, but what if it forces young people into the informal economy, where productivity is much lower?

Leave a Reply