In the context of its recent lethargy, it has been a somewhat eventful week for Apple (NASDAQ:AAPL) as it tries to get out of its slump. The week started with more speculation about a potential new dividend of share buy back, but that was once again met with silence from AAPL executives. As we have seen so many times recently, Monday’s late rally was met with selling the following day. The stock gave back its gains from Monday and retraced back to $425 level by Wednesday.

Everyone also had their eye this week on Samsung’s release of the new Galaxy S IV, hyped by some dramatists as the “iPhone killer.” Yesterday in the Virtual Trading Floor(R), on Twitter and in last night’s Off the Charts, we talked about the potential for the Samsung event to be a “buy the news” scenario for AAPL. It felt like everyone was expecting the Galaxy S IV release to be the knockout blow for this beaten down stock, but when the herd starts to widely adopt that type of stance, you can often see a counter-trend move once the news event passes.

According to International Data Corporation market research via The Wall Street Journal, Samsung dominated the global smartphone market last year with 39.6% share while Apple was left behind with 25.1% share. However, the launch of Galaxy S IV, which is an incremental update version to the Galaxy S III, appeared to be little threat to Apple’s iPhone market share. There were a few interesting bells and whistles, but it will be interesting to see how some of the gimmicks work once the phone is put into the hands of consumers.

AAPL’s price action overnight indicated that investors don’t necessarily feel the the new Samsung phone is a game-changer. The stock saw overnight gains on Friday’s morning while the broader market saw a small pullback from highs. AAPL opened at $437.25 and extended higher during the first 20 minutes to put in a current morning high of $442.50 as of 11AM.

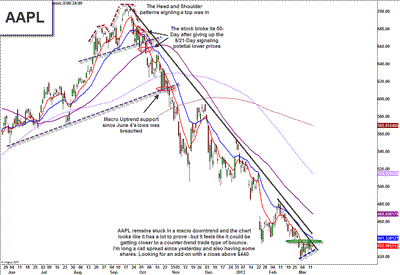

(click to enlarge)

Apple has been in a macro downtrend since September 2012. After losing the support of all key moving average and seeing a huge bearish gap after falling short of earnings expectations on January 24, the stock retraced all the way down to $420 key level, which was highlighted as the key downside target in my 2013 predictions. It then held this key support and has been inching higher into the 8-day before seeing a nice push through this moving average today. It has also perked above the 21-day moving average that is standing around $421. A close above this level could give the stock a chance to gain some momentum next week and break firmly out of this downtrend.

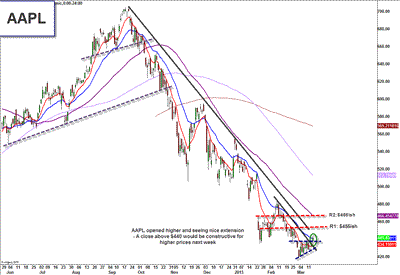

(click to enlarge)

I am long a call spread from yesterday and also having some common stock shares. I’m looking to add to my long position on a close above $440-441.

CNBC and the Wall Street Journal both included by analysis in AAPL blog posts earlier this week:

Apple Chart Looks So Bad That It’s Good – Patti Domm, CNBC, March 11, 2013

Apple Spikes on…What, Exactly? – Steven Russolillo and Ian Sherr, WSJ, March 11, 2013

Disclosure: Scott Redler is long AAPL calls spread, AAPL, MS, BAC, MGM, S, FB, SLB, YHOO, F

Leave a Reply