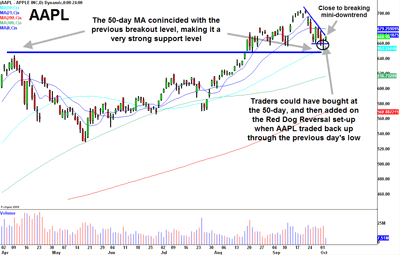

Last week Jim Cramer, on his CNBC show ‘Mad Money,’ shared my analysis and plan for trading Apple (AAPL) in the short-term and long-term. As AAPL started to break the 21-day moving average on that day, we laid out a plan to buy AAPL into its 50-day moving average, which was an even bigger support area because it represented the previous breakout level.

Yesterday, AAPL got that down move into the 50-day MA, only kissing the level before staging a strong bounce into the close. The move yesterday actually qualified for a Red Dog Reversal set-up because it traded down through the previous day’s low and then back up through it. (For the purposes of initiating a swing trade, we gave this Red Dog Reversal more clout than the one that occurred last Thursday because this one took place at a key macro support level). The stock built on that reversal by opening higher this morning, and is holding up well during the session. AAPL is nearly 20 points higher than the previous low.

(click to enlarge)

We detailed the execution of this trade live on the T3Live Virtual Trading Floor(R) (with some tidbits on my Twitter account). Not only did AAPL set-up a great swing entry by kissing its 50-day MA, but there was also a calculated intraday set-up that could have helped you time your entry. If you are a short-term momentum trader, you could have been content to take the intraday profits yesterday as AAPL bounced strongly, but for swing traders that set-up provided a great entry for a longer-term hold.

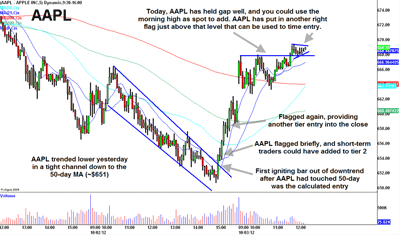

On the 5-minute chart you can see that AAPL, after some morning strength, trended lower in a tight channel most of the day. That channel took the stock all the way down to the 50-day MA around $651. The first igniting bar that broke us out of that channel after we had reach the 50-day was the calculated entry point. There were two brief pauses during the bounce that could have given traders a chance to add to their longs, and then, based on your time-frame, you could have taken the healthy profits at the close or held overnight for a swing trade. Today, AAPL opened higher, rewarding those with a swing strategy.

(click to enlarge)

Also, as you can see on the chart, intraday today there are points of reference to trade against in AAPL. The morning high of $668 was your calculated level to potentially add more to your day trading long position in the stock, and now AAPL is in a tight consolidation just above that level. A break higher out of that mini-consolidation would provide another calculated entry.

I am using this AAPL trade as an example of how you can trade stocks in a number of ways using technical levels based on your own personal time-frame. No matter whether you are a day trader or swing trader, you should have been aware of the significance of that 50-day MA level. Day traders should have been looking for intraday patterns at that level to get involved to the long-side (which was saw with the descending channel), and swing traders should have been looking to buy the dip at that key support level.

Disclosure: Scott Redler is long AAPL, SPY, FB, JPM, XHB.

Leave a Reply