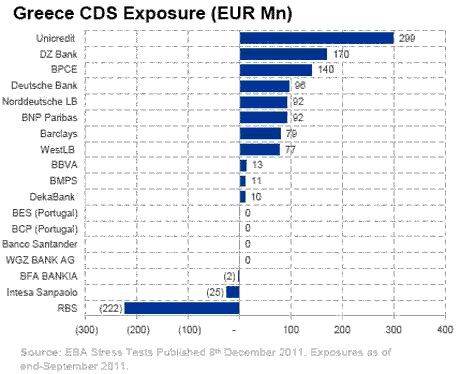

Nice chart from Ambrose Evans-Pritchard’s Telegraph piece. One would expect a relatively small first order effect if Greek CDS’ are triggered. The second order effects, such as contagion and the ding to market confidence are much more difficult to quantify and predict.

We have no idea what the take up on the bond swap participation will be. But we’ll make the over/under at 64 percent of all outstanding bonds x/ official holdings of the ECB and EIB, for example.

Lots of optimism and complacency out there. Guess zero interest rates and cen bank liquidity floats all boats. But will it put out the the political fires?

It’s going to be an interesting day.

Leave a Reply