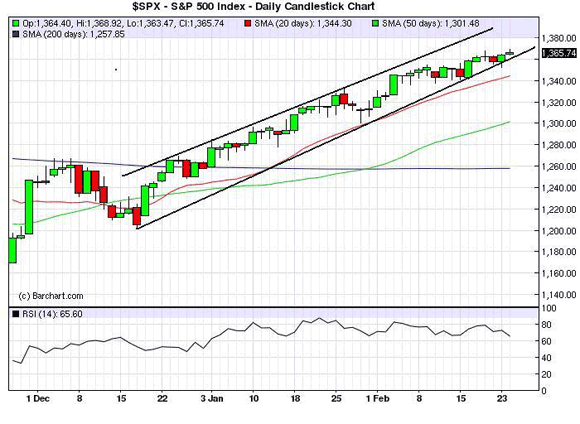

Waiting for a correction in the S&P500 has proven costly for those looking to get longer equities. Our view is that a move to 1340 is in the cards in the next week or two, which coincides with short-term support and the 20-day moving average.

The strong upward momentum has turned into just a slight drip higher over the past few trading sessions. The positive to this is that equities are working off a severe overbought condition. The S&P500′s 14-day RSI, for example, was over 82 on February 3rd and has fallen to 65.60 as of Friday’s close.

The bulls will see this as consolidating recent gains and basing before the next leg up. The bears? In their eyes the market has been freebasing for for quite some time. As traders we’re agnostic and trying to surf whatever waves the markets generate. As economists it’s really hard to see how this all ends without tears.

What really stands out to us in the chart, however, is the small number of red candlesticks since December 2oth. That is, 32 of the past 45 trading days, the S&P500 has closed higher than its open, which is reflected in the ubiquitous green candlesticks.

This has initially happened only three times since the turn of the new millennium — January and April 2010 and October 2006 — and prior to that was March 1995. Not exactly market tops. We don’t know what is causing this trading phenomenon. It could be just the lack of liquidity as trigger happy short sellers are forced to cover before the close as they continue to fight global central bank balance sheet expansion.

Whatever the case, higher oil prices do seem to be putting the kibosh on the market’s momentum and we expect, at the very least, a modest pullback in the next few weeks. Also note the relative weakness in the Russell last week. We’re using put spreads on the S&P50o ETF to express this view, mainly to hedge some long positions. If the index breaks 1340, it may be time to get shorty.

The big event this week is the ECB’s second LTRO. It’s going to be interesting to see the final take up and, more importantly, how the markets react to it.

Leave a Reply