Via Ryan Avent, Matt Yyglesias opines on the link between oil prices and monetary policy:

But it looks to me as if a demand-side oil issue is really just the same old issue of the trade deficit and the international balance of payments and not the second coming of a 1970s-style oil price shock. Perhaps it’s a monetary policy issue. We send dollars abroad in exchange for oil, but then the dollars get sent back in exchange for bonds. That ought to lower interest rates and induce investment in the United States, but nominal interest rates are already at zero so the loop is cut. Even so, higher gas prices should push the price level up which pushes real interest rates down which induces investment in the United States. The chain will only be broken here if the Fed decides to ignore its own self-guidance and target headline inflation instead of core inflation.

There is a lot going on in these few sentences, but I am going to focus on the last two lines. As a point of clarification, the Fed does not target core inflation. Refer to the Fed’s freshly printed statement on long-run goals and strategy:

The Committee judges that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory mandate.

That’s headline inflation, not core inflation. Of course, there is a near-term focus on core inflation, but not as a target, but as a guide to the path of headline inflation. Monetary policymakers should be wary about overreacting to movements in headline inflation if they are not evident in core inflation.

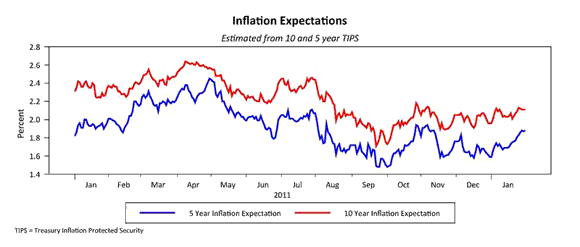

Consider also that the Fed is setting inflation expectations at 2 percent. Technically, expected, not current, inflation should be a determinant of investment spending. Which means that a spike in headline inflation should not stimulate investment spending via this channel assuming inflation expectations remain anchored. And, at this point, inflation expectations appear anchored:

Still below what we saw last spring. To be sure, we could see inflation expectations edge up, but anything significant would draw the attention of the Federal Reserve. I think they are pretty serious about that 2 percent target. In other words, I would be cautious about reading too much into a drop in ex-post real interest rates due to a rise in energy costs.

Note that this is a criticism of Fed policy at the zero bound, that by locking in inflation expectations at 2 percent they have effectively placed their most powerful remaining policy tool off-limits.

I could imagine that higher-gas prices induce additional investment via some other mechanism, such as increased purchases of energy efficient machinery, etc. But this would not necessarily be a sufficient offset to other, negative impacts of higher energy prices.

In any event, we are all struggling to extract a signal from the data – is this primarily a “good” shock that indicates improving global activity, or a “bad” shock due to a supply constriction? Arguably, both factors are at play – see Jim Hamilton here. Putting aside the possibility of a bad shock for the moment (I think we all agree that a supply disruption stemming from a conflict with Iran would be fairly negative, especially for Europe), I tend to see the challenge in terms similar to this from Reuters:

Looking past the near-term uncertainty surrounding Iran, Andrew Sentance, a former member of the Bank of England’s Monetary Policy Committee, said high and fluctuating prices for energy were part of a “new normal” economic climate in which Asia is the main engine of global growth.

Periodic bursts of inflation would add to the volatility of what was likely to be disappointing growth in the West for quite some time, according to Sentance, a senior economic adviser to PricewaterhouseCoopers, an accounting and advisory firm.

“This strong growth in Asia and other emerging markets is putting considerable pressure on markets for energy and other commodities and that is one of the reasons why we are finding growth so difficult to achieve,” he told a conference organized by the Institute of Economic Affairs, a free-market think tank in London.

“That’s not just a short-term phenomenon. It’s a secular issue that’s going to persist through the middle of this decade,” he said.

Even if higher oil prices are a symptom of improving global growth (a “good” shock) and do not trigger a US recession, they will certainly place some additional strain on US household budgets, which will in turn depress growth relative to what it would have been in the absence of the higher oil prices (consider instead the relatively low and stable prices of oil during much of the US boom during the 1990s). In effect, we could be running up against a global bottleneck that places something of a speed-limit on US (and global) growth.

Addendum:

As to the international finance story Yglesias tells, I think this does come back to a monetary policy story, but I think the direction might be backwards. I am still working this one out:

Yglesias is telling a story of recycling petro-dollars. In order to finance a given level of trade deficit, the dollar outflow must be recylced back into the US economy as a dollar inflow that supports some type of domestic absorption. I shy away from using the term “investment” strictly as it could support government spending or even consumption spending (think of households borrowing against home equity to buy a boat). If foreigners don’t not want to recyle their dollars back into the US economy via financial inflows, the value of the dollar falls to stimulate exports and deter imports, thus improving the external deficit.

Now, to Yglesias’ point, we may have something of an interesting situation whereby foreign investors find themselves holding dollar assets as cash or near-cash equivalents (low yielding Treasuries). And unless the federal government utilizes that potential via expanded borrowing (note that in the private sector, savings exceeds investment already), little additional demand is supported. Now it is interesting that foreign investors would prefer to hold relatively low-yielding assets rather than using their dollars to purchase US goods and services, but such is the outcome of so many dollars being held for central banks around the world.

As Yglesias’ says, the “loop” is cut, but not necessarily because of the zero bound, but by the global demand for dollars, which arguably is the cause of the zero bound. Which then does brings us back to Yglesias’ point that this is a monetary policy issue – policymakers could more actively drive down the value of the dollar by raising inflation expectations, thus making it increasingly unattractive for foreigners to hold cash or cash equivalents, and force the funds into either demand for US goods and services or investment goods. Certainly, however, policymakers would view this as a risky strategy, and thus have not gone down this road.

Leave a Reply