The seasonal pattern has a general rise in stocks from November to May, and we are seeing the market so far conform to that pattern. Usually within it is a February correction, leading to a number of January Tops over the past thirty years.

Sometimes that top marks a major reversal, as we saw in 2009 and 2000, but usually a month-long minor correction. Prechter has been predicting a major top now for the past two years, and a number of technicians have centered on a Jan 24 top prediction.

Now, often these timing predictions when they work mark a change of trend, but it is often hard to predict in advance which way. The market is in an uptrend right now, and might continue as such into next week, when this turn window occurs. This suggests a reversal down, conforming with the seasonal pattern. It still might be a minor correction, however.

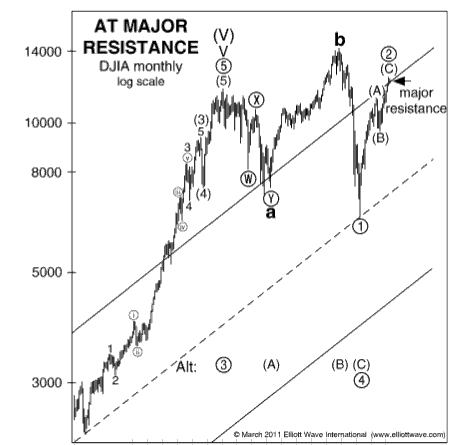

EWI has released through Club EWI a series of charts for the public, which add an additional factor, the approach of the market from below of a major trendline going back to 1932. As you can see from the chart above, the Dow in the late ’90s crested the upper trendline, which previously marked tops all the way since the 1930s, and stayed above until 2008. The drop in 2002 bounced from above off the trendline, indicating continuation of the uptrend.

Since the reversal back up in 2009, the market has moved in 3 waves (a corrective pattern) to touch the bottom of the upper trendline. Failure to break through for more than a short time (a “false break”) is bearish, indicting a fall down towards the lower trendline. Breaking back above and staying there is very bullish.

This suggests the January Top could be a major one, but step back and consider the broader picture. At trendline tests, a “jitter” or series of tests is common, and we might see a triple top or triple test over the next four to seven months. A false break is tested over the time frame of the pattern, and this one goes back decades, so a period which might seem longish to us (seven months) is but a blip in the broader time scale.

Hence it would not be surprising to see a test and a drop back – the February correction – followed by another test which might stay above the trendline for months – the typical bullish period of March to May at the end of the seasonal patern. If I can paint a scenario, we would then fall back in the summer and test one more time in late summer – the common August High before a serious Fall correction.

Leave a Reply