Shares of Dynamex Inc. (DDMX) jumped more than 12 percent to $23.70 after the same-day courier service said it had received a takeover offer of $23.50 a share that its board of directors viewed as a “superior proposal.”

The offer is higher than the $21.25 per share it was offered by an affiliate of Greenbrier Equity Group in October, and which Dynamex accepted last month. Greenbriar now has only four days to adjust the terms of its deal. If Greenbriar does not adjust the terms, Dynamex will pay it a $6.3 million termination fee and be acquired by the other firm whose offer expires on Dec. 1. Dynamex did not identify the bidder.

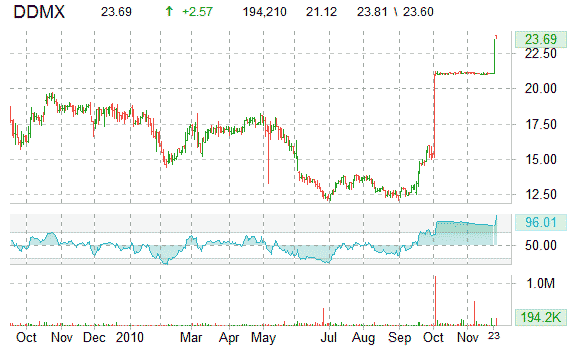

Technically speaking, the shares of DDMX, which are up more than 12% since the beginning of the year, are displaying strength this morning as the ticker breaks out to a new 1-year high over $19. The equity continues to see a strong volume; more than 190K shares have already traded hands compared to a daily average of around 71.5K.

Over the last three month, DDMX, which currently trades at a trailing P/E of 21.68, a forward multiple trailing twelve of 15.89 and a P/E to growth ratio of 0.95, has gained an impressive 89.6%.

The 50-day moving average in the name is $19.64 and the 200-day is $16.17.

At last check, shares of DDMX rose $2.57, or 12.8 percent, to $23.69 in midday trading.

Leave a Reply