With large budget deficits in place and projected going forward, as well as the expansion of the Fed’s balance sheet, there’s been some talk of inflationary pressures, and even hyper-inflation [0] McCain. I wondered if these fears were manifested in survey- and market-based expectations measures.

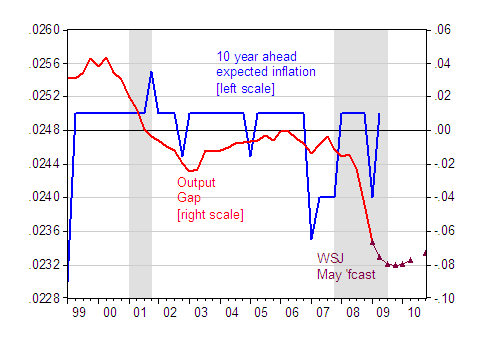

For certain, there is little pressure apparent in short term forecasts like the WSJ and Survey of Professional Forecasters. This makes sense (at least if one believes in the Keynesian conception of an output gap [1]) given the amount of slack displayed in Figure 1.

Figure 1: Median expected ten year inflation recorded as of second month of each quarter, from Survey of Professional Forecasters (blue, left scale), actual CBO-defined output gap (red line), and WSJ forecasted (purple triangle), in log percentage points. NBER defined recessions shaded gray; second recession assumed to end 2009Q3. Source: Cleveland Fed, BEA, GDP 2009Q1 advance release, and WSJ May survey [xls], and CBO potential GDP (9 January 2009).

I also plot the median expectation of ten-year inflation. Note that this measure has not budged much at all.

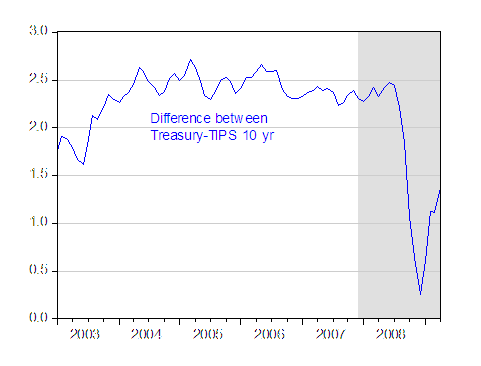

This data, of course, will not convince those skeptical of survey-based measures. What about market based measures? The standard approach is to subtract the TIPS yield from the Treasury yield. We know for a variety of reasons, this calculation can lead to misleading results. However, the Cleveland Fed has stopped publishing its adjusted series:

October 31, 2008

We have discontinued the liquidity-adjusted TIPS expected inflation estimates for the time being. The adjustment was designed for more normal liquidity premiums. We believe that the extreme rush to liquidity is affecting the accuracy of the estimates.

With that caveat in mind, Figure 2 displays the implied ten year expected inflation rate.

Figure 2: Difference between ten year constant maturity Treasury yields and ten year constant maturity TIPS, monthly data. Series GS10 and FII10. Source: St. Louis Fed FRED.

Some people are looking to commodity prices as indicators of expected inflation. I’d say that making inferences this way is fraught with difficulties, because changes in such commodity prices will incorporate both relative price and price level effects.

So, there’s little evidence now of inflationary pressures. That being said, there’s plenty to worry about as time goes on (as Jim recounts). And even if inflationary expectations remain well anchored, we do have to keep an eye on possible crowding out due to higher interest rates (all of us, except Dick Cheney, who didn’t ever worry about deficits as the Bush Administration ran up trillions in debt [3]).

Leave a Reply