Halliburton (HAL) continues to profit from increased activity in the unconventional natural gas and oil basins in the US as well as strong international growth in Russia, Asia Pacific, and Latin America.

Growth and Income

The company is expected to grow its earnings per share 36.2% in 2010, 30.3% in 2011, and 13.0% over the long term. Its trailing 12-month return on equity is 14.2%. The stock also offers investors a dividend yield of 1.2%.

This Zacks #2 Rank stock trades at 17x 2010 consensus EPS estimates and 13x 2011 consensus EPS estimates.

Business

Halliburton provides various products and services to the energy industry for the exploration, development, and production of oil and natural gas worldwide.

Recent News

On July 19, Halliburton announced second-quarter revenue of $4.4 billion, an increase of 25.6% from the year-ago quarter. The company had earnings of $0.52 per share, topping the Zacks Consensus by 15 cents, or 40.5%.

In the last five quarters, Haliburton has beaten the Zacks Consensus Estimate by 16.5%

Estimates

In the last month, the Zacks Consensus Estimate for 2010 is up 41 cents, or 28.7%, to $1.84. The Zacks Consensus Estimate for 2011 is up 33 cents, or 16.0%, to $2.39.

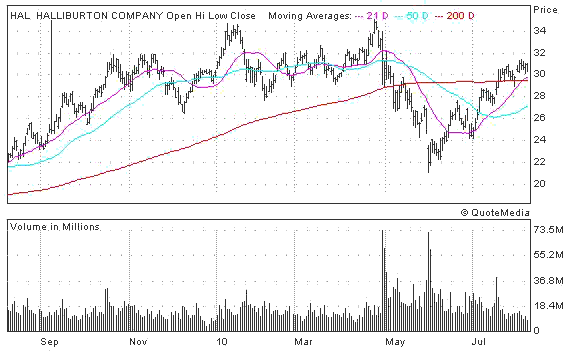

The Chart

Even after a HAL’s recent 30% climb, the stock is still about 13% off its 52-week highs. HAL’s sharp sell-off the spring was due to the disaster in the Gulf of Mexico and subsequent drilling stoppages. Its recent rally, however, is strong and should have legs over the next few weeks and months.

Leave a Reply