Ever since he made his presidential bid in June 2015, Donald Trump has vowed to “make America great again.” Part of that promise includes rebuilding the nation’s infrastructure, a monumental task that will require the financial backing of tax-free municipal bonds.

“We are going to fix our inner cities and rebuild our highways, bridges, tunnels, airports, schools, hospitals,” the president-elect told reporters the day after his historic victory. “We’re going to rebuild our infrastructure, which will become, by the way, second to none.”

To accomplish this, Trump has proposed a spending package as high as $1 trillion over the next 10 years. Although the private sector will be expected to finance a large portion of the work, massive amounts of public debt will be necessary.

This could be a “very big item for the muni market in the coming years,” according to John Vahey, managing director of federal policy for Bond Dealers of America, a trade association for fixed-income dealers.

Americans already appear eager to get started repairing their infrastructure, which is facing a $3.6 trillion shortfall, according to the American Society of Civil Engineers (ASCE).

So far this year, state and local governments have issued nearly $150 billion in municipal bonds for new infrastructure projects, putting 2016 borrowing on a path to exceed levels in each of the last five years. And on Election Day, U.S. voters approved $55.7 billion in debt, the most since 2008.

Stay the Course

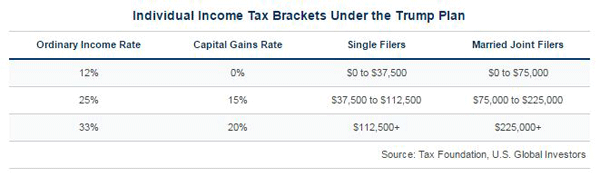

A possible headwind for munis is Trump’s proposal to reduce the top marginal income tax rate, from 39.6 percent to 33 percent. Although good for your pocketbook, such a move could limit the appeal of munis’ tax-exempt status among some top-earning investors.

Other investors might be dazzled by what the media are calling the “Trump rally.” With the Dow Jones Industrial Average ending at a record high on Monday and Tuesday, munis could lose favor as investors increase their exposure to equities.

However, it’s important that we don’t overreact to market swings. A well-structured, diversified portfolio—one that also includes munis—is still the most prudent strategy going forward.

Reduce Volatility with Short-Term, Investment-Grade Munis

Something else to keep in mind are interest rates. It’s highly expected that the Federal Reserve will raise them next month, the first time it would do so since December of last year.

Even though rates will likely be lifted as little as 0.25 percent, it’s important to be aware that when rates rise, bond prices fall. At first glance, this inverse relationship might seem illogical, but it makes sense. If newly-issued bonds carry a higher yield, the value of existing bonds with lower rates declines.

That’s why investors should consider taking advantage of shorter-duration, investment-grade munis, which are less sensitive to rate increases than longer-term bonds whose maturities are further out.

Leave a Reply