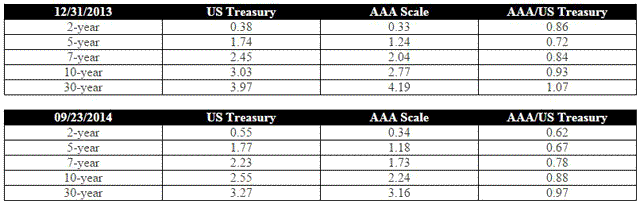

The tax-free bond markets are finishing up the third quarter of 2014 with little change in overall yields after the large rally in the bond market during the first half of this year. AAA scales in the muni market are essentially unchanged in the 5- and 10-year range (1.20 and 2.25), while long AAA yields have dropped about 10 basis points in the quarter to 3.15. What is significant is that in the highest grade of municipal debt, the entire municipal bond yield curve is now BELOW the corresponding US Treasury curve.

How did we get here? A number of events have helped in this regard. Bond fund flows have improved this year, after the hemorrhaging of 2013. This trend has helped stabilize a market that was already starting to recover when flows were still negative towards the end of last year.

Until recently, new-issue municipal bond supply was down over 20% on a year-over-year basis, as most issuers who have flexibility in financing decided to wait and not to issue debt when long tax-free yields were near 5% late last year. With yields significantly lower, we have seen a pickup in new issues. Supply is now down about 10% on a year-over-year basis.

Away from Puerto Rico and Detroit, most municipal credit quality has improved. A combination of factors has helped municipalities. A better economy with more consumer spending and falling unemployment has been a rising tide that has carried most municipal issuers forward. A rebounding real-estate market in most states has certainly helped property tax-based bonds as well.

Where do we go from here? At Cumberland Advisors, we have reduced duration in total-return tax-free accounts over the past quarter. In general, durations have been reduced from the 6–7 range down to the 4–5 range.

There are several reasons for this move. This year, interest rates are down while inflation has picked up. During 2013’s “taper tantrum” we witnessed long tax-free bond yields climb almost 150 basis points as bond-fund selling went unabated last summer. However, trailing inflation (the headline Consumer Price Index – CPI) fell from 2% to 1% last year. That same 5%-plus long muni yield is now 3.6% for AA debt, and the headline CPI number is now 1.7%. It has climbed as high as 2%. Thus REAL, long-term, tax-exempt municipal bond rates are down significantly, from near 4% to approximately 2%. They are still attractive but are not nearly the giveaway that they were in 2013.

Supply is picking up. The Bond Buyer Visible Supply (which covers 30 days of new issues to be offered) jumped from under $4 billion to over $12 billion after Labor Day (see the following chart). We expect supply to remain strong over the next year for two reasons. (1) Issuers are much more prone to issue bonds now that rates have moved down nominally from the high levels of last year. This is normal. (2) Issuers will be bringing billions of dollars of bonds to the market in 2015 and 2016 to refund bonds that were issued in 2005 and 2006 and that carried 10-year call protection. Most of this paper carried approximately 5% coupons, so issuers will simply issue paper at 4% or less. They will call in these older bonds and immediately realize cost savings. However, these issuers must clear the market.

Furthermore, the ratio drop of tax-exempt to US Treasury yields (see chart above) will encourage issuers to advance refund older-higher coupon bonds to their first call dates in 2018-2023. This defeasance lowers the maturity of the advance refunded bond. The ability to issue debt at rates that are at or below US Treasury yields is key to this process. Recent longer-term ratios make this doable. To that end Cumberland Advisors has positioned some longer-term paper with shorter calls that are candidates to become pre-refunded by their issuers.

Leave a Reply