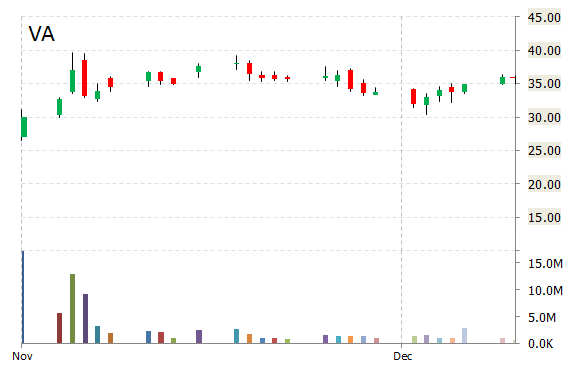

Virgin America Inc. (VA) gained 2.23 to $38.04 in morning trading today, after the company was initiated with a ‘Buy’ at Deutsche Bank. The firm also set its price target on the stock to $44 a share.

Virgin America was also initiated with an ‘Outperform’ at Cowen and an ‘Overweight’ at Barclays, with a $42 and $44 price target on the stock.

In the past 52 weeks, shares of the airline company have traded between a low of $26.50 and a high of $39.64 with its 50-day MA and 200-day MA located at $34.86 levels, respectively.

VA, which closed Tuesday at $35.81, has a total market cap of $1.67B.

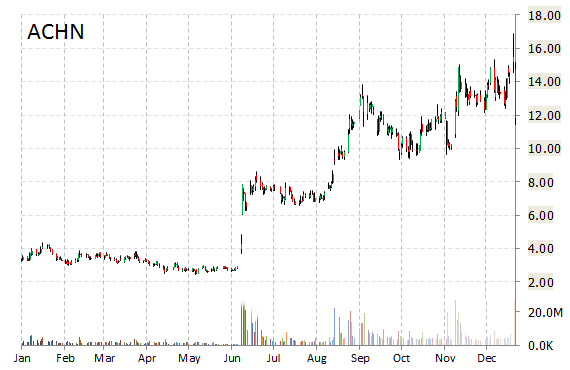

Shares of Achillion Pharmaceuticals, Inc. (ACHN) are up 1.20 to $13.04 in morning trading, after some positive comments by Piper Jaffray analysts.

ACHN’s shares have declined 10.03% in the last 4 weeks and advanced 4.87% in the past three months. Over the past 5 trading sessions the stock has lost 8.36%. Shares of Achillion Pharma are up 256.63% this year.

The New Haven, Connecticut-based company, which is currently valued at $1.34B, has a median Wall Street price target of $16.00 with a high target of $25.00.

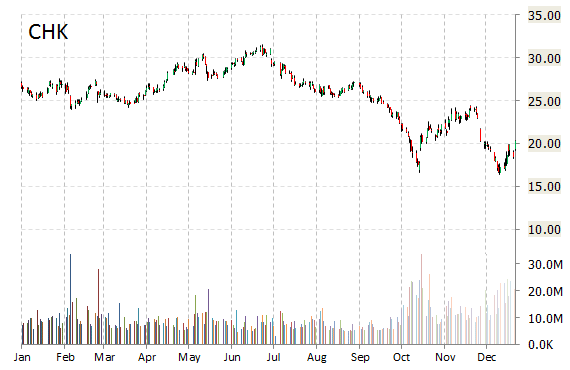

Chesapeake Energy Corporation (CHK) was raised to ‘Equalweight’ from ‘Underweight’ at Capital One on Wednesday. Separately, Wunderlich and Maxim Group maintained a ‘Buy’ rating on the name.

CHK shares are currently priced at 24.76x this year’s forecasted earnings, which makes them relatively expensive compared to the industry’s 14.53x earnings multiple. The company’s current year and next year EPS growth estimates stand at 10.00% and -21.20% compared to the industry growth rates of 8.80% and -5.00%, respectively. CHK has a t-12 price/sales ratio of 0.65. EPS for the same period registers at 0.81.

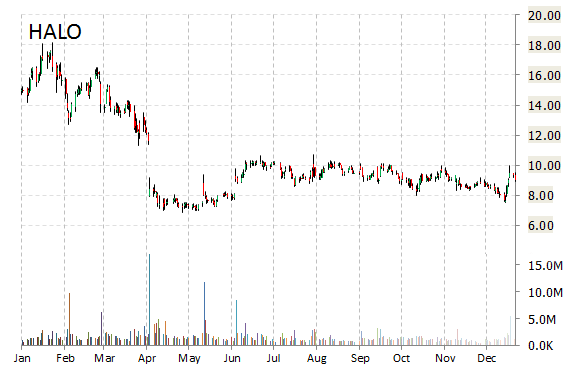

MLV & Co analysts are out with a report this morning initiating coverage of Halozyme Therapeutics, Inc. (HALO) with a ‘Buy’ rating and $12 price target. Shares of Halozyme Therapeutics are trading up more than 5.20% to $9.53 in Wednesday’s session.

Halozyme Therapeutics, currently valued at $1.17B, has a median Wall Street price target of $13.00 with a high target of $24.00.

In the past 52 weeks, shares of the biopharmaceutical company have traded between a low of $6.88 and a high of $18.18 with the 50-day MA and 200-day MA located at $8.68 and $9.28 levels, respectively.

HALO currently prints a one year loss of about 41.29% and a year-to-date loss of around 39.76%.

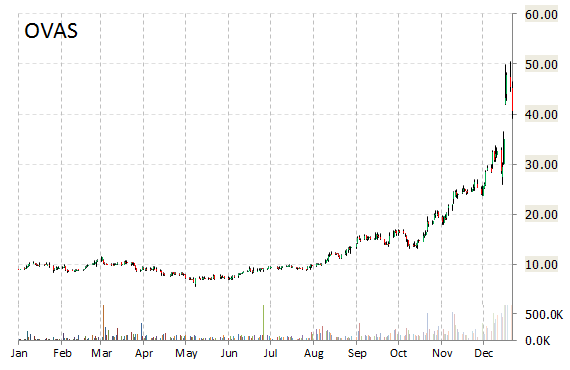

Oppenheimer analysts are out with a report this morning upgrading the shares of OvaScience, Inc. (OVAS) to ‘Outperform’ from ‘Perform’.

OVAS’s shares have advanced 66.37% in the last 4 weeks and 187.10% in the past three months. Over the past 5 trading sessions the stock has gained 37.88%. Shares of OvaScience are up 343.22% this year.

The Cambridge, Massachusetts-based company, which is currently valued at $1.05B, has a median Wall Street price target of $55.00 with a high target of $100.00.

Leave a Reply