On Friday, Goodrich Petroleum Corp. (GDP) printed a higher than average trading volume with the issue trading 7.95M shares, compared to the average volume of 2.11M. The stock began trading at $7.52 to finish the session 34% lower from the prior days close of $9.20. The plunge came one day after OPEC’s decision to hold production steady at 30 million barrels a day. On an intraday basis ticker got as low as $5.60 and as high as $7.59.

On valuation measures, GDP’s current year and next year EPS growth estimates stand at 31.80% and 39.70%, compared to the industry growth rates of 10.80% and 6.50%, respectively. The name has a t-12 price/sales ratio of 1.94. EPS for the same period registers at ($4.12).

Profitability-wise, GDP’s T-12 profit and operating margin currently are (71.62%) and (45.44%), respectively. The company reported $2.21 million in cash vs. $609.46 million in debt in its most recent quarter.

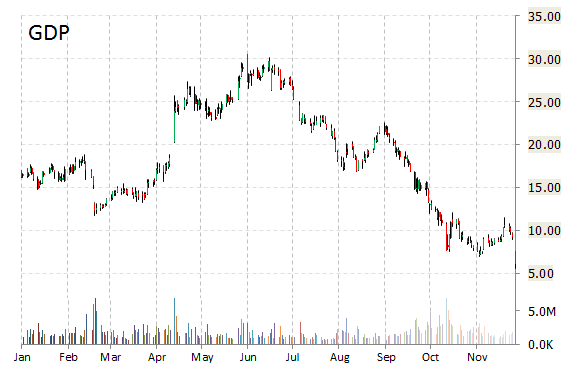

GDP’s shares, which were downgraded to ‘Sector perform’ from ‘Outperform’ in a research report released on Friday morning, have declined 30.46% in the last 4 weeks and 72.62% in the past three months. Over the past 5 trading sessions the stock has lost 41.21%.

The Houston, Texas-based oil and natural gas company, currently valued at $268.83M, has a median Wall Street price target of $19.00 with a high target of $35.00. GDP is down 68.27% year-over-year, and 64.45% year-to-date.

Leave a Reply