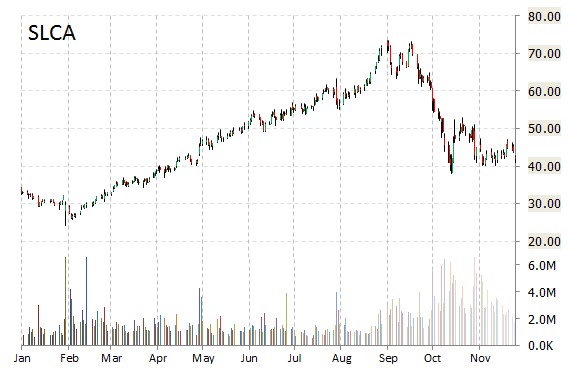

U.S. Silica Holdings, Inc. (SLCA) is one of today’s notable stocks in decline, down as much as 25 percent to $31.42. About 7.12 million shares were traded as of 1:06 p.m EST., compared to the normal trading volume of 3.19 million shares a day. Not seeing any news to account for the move.

On valuation-measures, shares of U.S. Silica Holdings have a current quarter consensus EPS estimate of $0.73, a trailing-12 and forward P/E of 16.30 and 8.91, respectively. P/E to growth ratio is 0.58, while t-12 profit margin is 13.49%. EPS registers at $1.93. The company has a market cap of $1.69 billion.

On trading-measure, SLCA has a beta of 3.50 and a short float of 16.33%. In the past 52 weeks, shares of the Frederick, Maryland-based producer of commercial silica in the U.S. have traded between a low of $24.28 and a high of $73.43 with the 50-day MA and 200-day MA located at $44.96 and $54.79 levels, respectively.

SLCA currently prints a one year loss of about 5.30% and a year-to-date loss of around 7.9%.

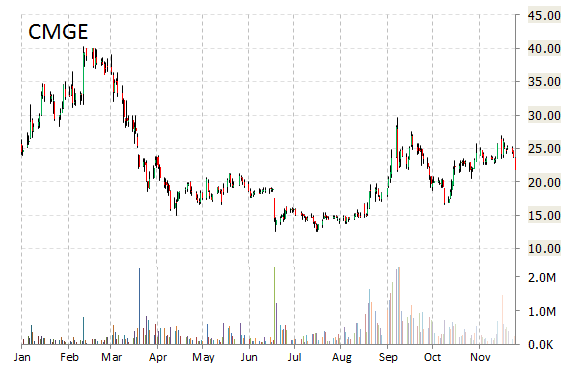

China Mobile Games and Entertainment Group Ltd. (CMGE) gained 17% to $25.58 in mid-day trading today. Approximately 740K shares have already changed hands, compared to the stock’s average daily volume of 640,234K.

On valuation-measures, shares of China Mobile Games and Entertainment Group are currently priced at 24.52x this year’s forecasted earnings compared to the industry’s 17.35x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.15 and 10.57, respectively. Price/sales for the same period is 4.22, while EPS is $1.03. Currently there are 3 analysts that rate CMGE a ‘Buy’. No analyst rates it a ‘Hold’ or a ‘Sell’. CMGE has a median Wall Street price target of $32.00.

In the past 52 weeks, shares of Guangzhou, China-based company have traded between a low of $12.58 and a high of $40.31. Shares are up 37.27% year-over-year and 1.39% year-to-date.

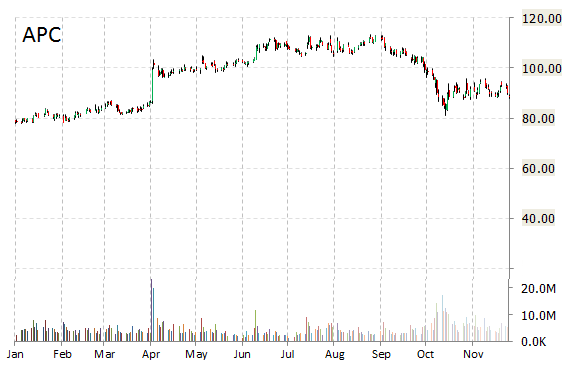

Anadarko Petroleum Corporation (APC) shares are trading lower by nearly 11% to $79.15 following OPEC’s decision not to cut current levels of output. Approximately 9.9 million shares have already changed hands, compared to the stock’s average daily volume of 5.61 million shares.

During the trading session, APC opened sharply lower Friday and kept printing lower lows for the majority of the morning, before settling into an intraday range of $78.71 to $79.15 with its 52-week range being $73.60 to $113.51.

Fundamentally, APC shows the following financial data:

· $8.34 billion in cash

· $7,108,000 total current assets

· $16.87 billion t-12 revenue

· $801,000 quarterly net income

On valuation measures, Anadarko Petroleum shares have a T-12 price/sales ratio of 2.66 and a price/book for the same period of 2.17. EPS is ($4.21). APC has a market cap of $40.09B and a median Wall Street price target of $119 with a high target of $135.00. Currently there are 19 analysts that rate APC a ‘Buy’, 6 rate it a ‘Hold’. No analysts rates it a ‘Sell’.

Shares of the The Woodlands, Texas-based oil producer are down 13.98% year-over-year ; flat year-to-date.

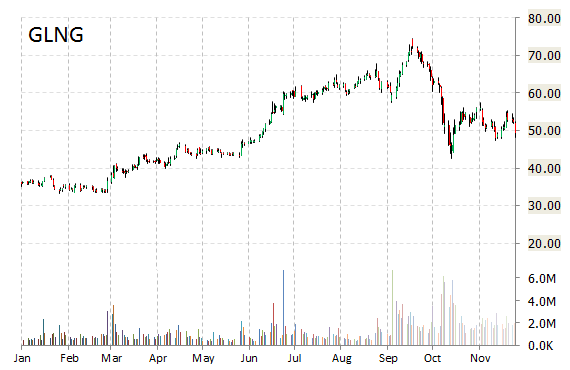

Golar LNG Ltd. (GLNG) shares tumbled 16% to $41.52 in midday trade Friday after the company’s price target was lowered to $52 from $57 by analysts at Jefferies. The equity research firm maintained their ‘Hold’ rating on the name. Jefferies new price target represents a potential downside of 20% from ticker’s current pps.

Golar LNG is a midstream liquefied natural gas (LNG) company headquartered in Hamilton, Bermuda. Its stock has a 52-week trading range of $33.07 to $74.44. The T-12 profit margin at GLNG is (0.93%). The name‘s revenue for the same period is $90.64 million. Golar’s price/book is 1.93. Currently there are 12 analysts that rate GLNG a ‘Buy’, 3 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’.

Shares in the $3.87B company are up 10.13% year-over-year, and 14.41% year-to-date.

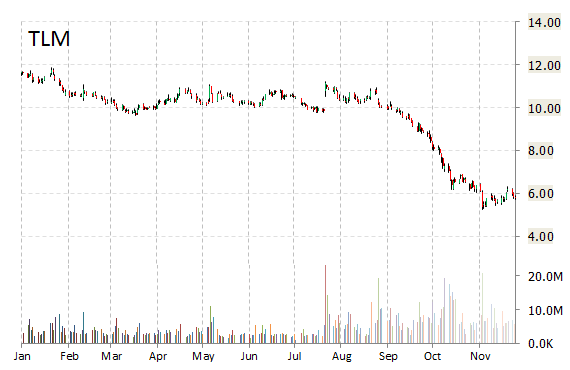

Talisman Energy (TLM) – Shares plunged more than 19% to touch a new 52-week low of $4.51 after OPEC decided at a meeting in Vienna yesterday to keep its output target unchanged.

On valuation measures, Talisman Energy shares have a PEG and forward P/E ratio of 11.66 and 67.29, respectively. Price/sales for the same period is 1.20 while EPS is ($0.41). Currently there are 5 analysts that rate TLM a ‘Buy’, 14 rate it a ‘Hold’. 1 analyst rates it a ‘Sell’.

In the past 12 months, shares of Calgary, Canada-based company have traded between a low of $4.51 and a high of $12.26. Shares are down 60.65% year-over-year and 59.40% year-to-date.

Leave a Reply