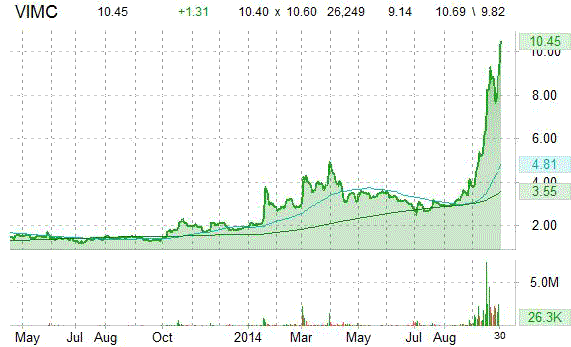

Shares of video surveillance solution provider Vimicro International Corp. (VIMC) are up 14% after the company this morning announced that its joint venture, Shanxi Zhongtianxin Science and Technology Co. Ltd. (“Zhongtianxin”), has won a $12.4 million contract to provide SVAC-compliant video surveillance cameras and system to the Traffic Police Detachment of Taiyuan. The project is expected to be completed by early 2015.

Vimicro Corp also announced that Shanxi Zhongtianxin Science and Technology has reached an agreement on Project Financing and Strategic Cooperation with CITIC Bank Taiyuan Branch, including a revolving credit line of up to $65M.

VIMC has a forward P/E of 30.47 and t-12 price-to-sales ratio of 2.94. EPS for the same period is ($0.04).

In the past 52 weeks, shares of Beijing, China-based firm have traded between a low of $1.35 and a high of $9.88 and are now at $10.40. Shares are up a staggering 608.53% year-over-year and 371.13% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

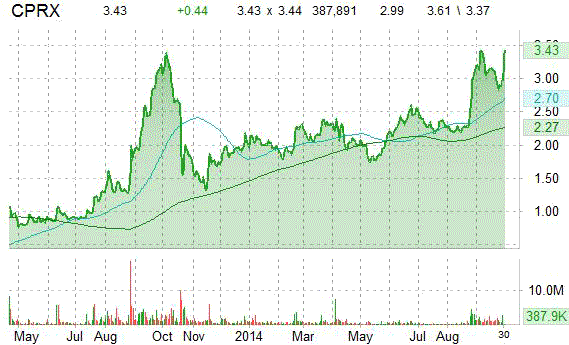

Shares of Catalyst Pharmaceutical Partners (CPRX) are up almost 14% in pre-market trading Tuesday after the company reported positive top-line results from the pivotal Phase 3 clinical trial of Firdapse™ (amifampridine phosphate tablets equivalent to 10 mg amifampridine) for the symptomatic treatment of Lambert-Eaton myasthenic syndrome [LEMS].

Patrick J. McEnany, Chief Executive Officer of Catalyst Pharmaceuticals, stated, “Today is an important day for LEMS patients and their families as the results from this Phase 3 trial were very positive.”

CPRX shares recently gained $0.46 to $3.45. The stock is down more than 7.40% year-over-year, while gaining roughly 54% year-to-date. In the past 52 weeks, shares of Coral Gables, Florida-based company have traded between a low of $1.29 and a high of $3.65.

Catalyst Pharmaceutical Partners Inc., which closed Monday at $2.98, has a total market cap of $200.84M.

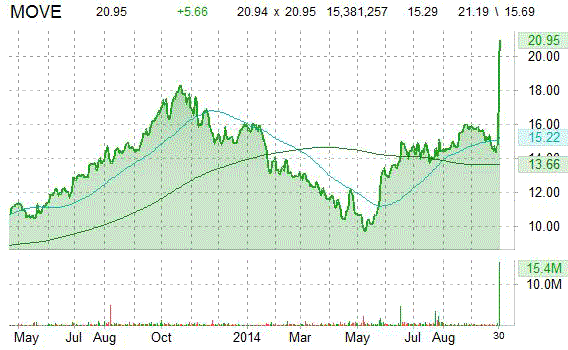

Move, Inc. (MOVE) is a big mover this pre-market session, as its shares are up 37%. The surge came after the company announced that is has agreed to be acquired by News Corp (NWSA) for $21 per share, or $950M, via all-cash tender offer. The transaction represents a premium of 37% over MOVE’s closing PPS on Sept. 29.

“News Corp’s acquisition of Move speaks powerfully to the quality and value of our content, audience and industry relationships,” said Steve Berkowitz, Chief Executive Officer of Move. “…News Corp shares our vision, which is one of the many reasons this combination is such good news for our customers, consumers and the industry as a whole.”

MOVE shares recently gained $5.69 to $20.98. The stock is down more than 7.70% year-over-year and roughly 4.38% year-to-date. In the past 52 weeks, shares of San Jose, California-based company have traded between a low of $9.47 and a high of $18.36.

Move, Inc., which closed Monday at $15.29, has a total market cap of $614.26M.

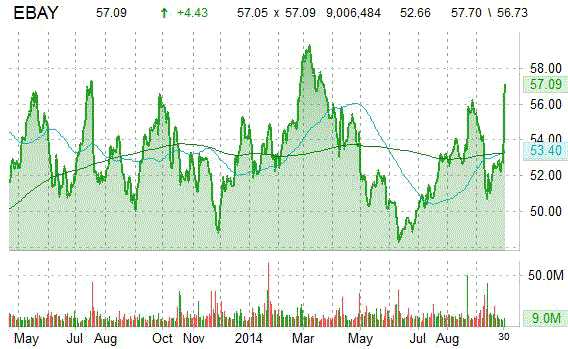

Shares of eBay Inc. (EBAY) are up almost 11% in pre-market trading Tuesday after announcing plans to spin-off PayPal into a publicly traded company in the second half of 2015. The company said it expects to complete the transaction as a tax-free spin-off in the second half of 2015, subject to market, regulatory and certain other conditions.

According to the company’s press release, Devin Wenig, currently president of eBay Marketplaces, will become CEO of the new eBay company, while Dan Schulman will be President of PayPal, effective immediately, and CEO-designee of the standalone PayPal company following separation.

President and CEO John Donahoe and CFO Bob Swan will oversee the separation and serve on the boards of both companies.

On valuation-measures, eBay shares have a PEG and forward P/E ratio of 1.41 and 15.58, respectively. Price/Sales for the same period is 3.85 while EPS is ($0.09). Currently there are 12 analysts that rate EBAY a ‘Strong Buy’, 11 rate it a ‘Buy’ and 16 rate it a ‘Hold’. No analysts rate it a ‘Sell’. EBAY has a median Wall Street price target of $59.50 with a high target of $66.00.

In the past 52 weeks, shares of San Jose, California-based company have traded between a low of $48.06 and a high of $59.70 and are now at $57.14. Shares are down 5.59% year-over-year and 4.03% year-to-date.

Leave a Reply