Shares of Peabody Energy Corp. (BTU) were downgraded to a ‘Sell’ rating from ‘Neutral’ by Goldman Sachs (GS) on Thursday. The firm also cut its 12-month base case estimate to $13.00 from $15.00. Goldman’s price target would suggest a potential downside of 3.20% from the stock’s current price.

BTU shares recently lost $0.78 to $13.42. Approximately 5.98M shares have already changed hands, compared to the stock’s average daily volume of 6,390,770 shares. In the past 52 weeks, shares of St. Louis, Missouri-based company, which is engaged in the mining of coal, have traded between a low of $13.40 and a high of $21.28. Shares are down 28.92% year-over-year and 31.29% year-to-date.

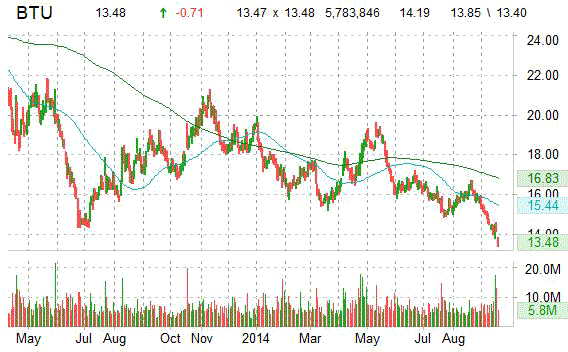

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Pier 1 Imports, Inc. (PIR) was downgraded by Wells Fargo (WFC) analysts to ‘Market Perform’ from an ‘Outperform’ rating Thursday. The name was also downgraded at Barclays to ‘Equal Weight’ from ‘Overweight’. The firm said it was also lowering its price target on the stock to $14 from $18 a share, citing accelerating expenses and slower revenue growth following the company’s Q2 earnings report.

Pier 1 Imports shares are currently priced at 12.73x this year’s forecasted earnings compared to the industry’s -9.43x earnings multiple. Ticker has a PEG and forward P/E ratio of 0.89 and 9.74, respectively. Price/Sales for the same period is 0.82 while EPS is $1.01. Currently there are 7 analysts that rate PIR a ‘Strong Buy’, 3 rate it a ‘Buy’ and 5 rate it a ‘Hold’. No analysts rate it a sell. PIR has a median Wall Street price target of $18.50 with a high target of $28.00.

In the past 52 weeks, shares of Fort Worth, Texas-based retailer have traded between a low of $12.71 and a high of $23.98 and are now at $12.87. Shares are down 45% year-over-year and 43.76% year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Analysts at CRT Capital continue to recommend against longing shares of TASER International Inc. (TASR), suggesting ticker is ‘Fair Value’ rated with a $12 price target. The firm said in a research note on Thursday that it would continue to stay on the sidelines and likes TASR as a short candidate in the low $20s. CRT also said it sees the market of on-officer cameras as limited and quite competitive and that traders should watch insider activity as management has a history of timing the market. CRT’s $12 PT implies a potential downside of 27.84% from the stock’s current $16.63 pps.

TASER International Inc. shares are currently priced at 48.97x this year’s forecasted earnings compared to the industry’s 15.06x earnings multiple. Ticker has a PEG and forward P/E ratio of 1.80 and 37.80, respectively. Price/Sales for the same period is 6.08 while EPS is $0.34. Currently there is one analysts that rates TASR a ‘Strong Buy’, 2 rate it a ‘Buy’ and 1 rates it a ‘Hold’. No analysts rate it a ‘Sell’. TASR has a median Wall Street price target of $18.00 with a high target of $19.50.

In the past 52 weeks, shares of the Sunnyvale, California-based company have traded between a low of $10.46 and a high of $20.83 and are now at 16.65. Shares are up % year-over-year and % year-to-date.

The chart below shows where the equity has traded over the last year, with the 50-day and 200-day moving averages included.

Leave a Reply