Facebook’s stock price briefly hit $38, its IPO price, just before today’s opening bell. In the 15 months since it went public, the stock had certainly had its ups and downs as evidenced in this graph:

(click to enlarge)

As some of you who have tracked my blog posts over the last couple of years know, I have tried to make sense of Facebook’s value and how the market has been pricing it. Given today’s news, I thought it would be useful to go back first to these earlier posts and then do a fresh valuation of the company, with updated information.

The lead up to the IPO

Facebook had perhaps the most elaborate run-up to an IPO in stock market history, with billions of dollars in transactions in the private share market, stories aplenty in the news media and even a hit movie about its founders. My first attempt at valuing Facebook was in February 2012, when I attached a value of $68 billion to its equity, with extremely generous assumptions on revenue growth and margins. In estimating this value, I assumed that Facebook would have a revenue growth path very similar to Google’s, while sustaining operating margins like Apple.

As the initial public offering drew nearer, I grew increasingly wary about the offering for two reasons. The first was the sense that many investors, especially institutional, seemed to think that the Facebook IPO was an absolute no-lose proposition, no matter what the offering price was, since momentum would carry the stock higher. In this post, from February 2012, I cautioned investors from buying into this proposition. The second was that the company and its bankers seemed to assume that they could set the terms for the offering and that the market could go along. In my experience, those who believe that they have power over markets realize otherwise, sooner rather than later.

The IPO

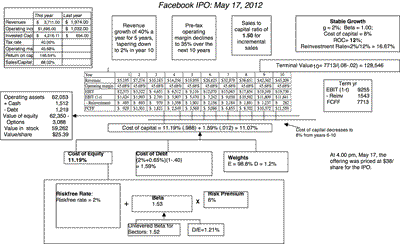

On May 17, 2012, just after the lead investment banks set the offering price at $38/share and the day before the offering date, I did my final pre-IPO valuation and estimated a value per share of about $25/share. While you can get the excel spreadsheet containing the valuation in this post, I think this picture better illustrates the assumptions and linkages that went into my estimate of value:

(click to enlarge)

The actual offering date is now part of market lore, from the technical problems that NASDAQ had in getting the trading started to the substantial support that the investment banks had to offer to keep the price from collapsing. After an initial spurt in the price to $42, the stock ended the day at $38.23 a share.

Once the price support faded, the stock price retreated in the weeks after the IPO to drop below $30 in June 2012. In a post after the IPO, I argued that the market reaction to the IPO was just desserts for the arrogance and hubris of both investment bankers and the company in the lead up to the IPO.

The Early Returns

In the months after the IPO, Facebook faced a mountain of troubles, some of its own doing and some reflecting the costs of going public. The IPO failure colored investors’ views of the company and its management, leading them to put the worst possible spin on every action and occurrence at the company. At the same time, the IPO also exposed the company to significant costs, especially as the costs of stock-based compensation were recognized, leading to a drop in operating income. The nadir for the stock was the quarterly earnings report about a year ago, when the company reported sagging revenue growth and much lower margins. The momentum game turned fully against the company, with many of the analysts and institutional investors who had been cheerleaders in the pre-IPO days arguing that the stock was a “sell”.

On August 20, 2012, Facebook had dropped below $20/share and I made an argument that the market had over reacted to news and that the earnings reports were not as catastrophic as they were perceived to be. I also argued that investors were being distracted by side stories about expiring lock ups and mobile mashups. In fact, my estimate of value in August 2012 was $23.94, just a couple of dollars below my estimate on the day before the IPO. At the end of the post, I noted that I had a limit buy order at $18/share on the stock and that notwithstanding my concerns about corporate governance in the company and the near term effects of momentum, it looked like a decent buy.

Now, a confession. I had never, ever bought a stock on the date that it hit its absolute low, until my limit order for Facebook got fulfilled at the start of trading on September 4, 2012. The stock hit its low of $17.58 that day and, even with setbacks along the way, it has not looked back since. I would love to claim timing precision but it was absolute luck, and I would rather be lucky than good.

Learning from Earnings: Updating the Facebook valuation

If the first two earnings reports were viewed as negative surprises, they did bring expectations down for the company and the company has delivered positive earnings reports in its last three earnings reports. While it is easy to get lost in the minutia of these reports, here are the news stories that I see embedded across the earnings reports:

- Revenue growth continues to be strong: Revenues at the company over the first two quarters of the current financial year have been about 46% higher than revenues in the first two quarters of the last financial year, just above the expected growth rate of 40% used in the IPO valuation.

- Operating margins remain high: Operating margins declined last year, primarily because of the expensing of stock-based compensation from pre-IPO days. That load has been lifted in this fiscal year and the operating margin over the last four quarters is about 30%, if R&D is expensed, and closer to 40%, if it is capitalized.

- Facebook remains for the most part an “advertising” company: While Facebook has made attempts to broaden its revenue base and product mix, it remains dependent upon advertising for 84% of its revenues in the last four quarters, not significantly different from pre-IPO days.

- Facebook seems to have broken the “mobile media” code: It is true that the last few earnings reports have included good news on the mobile media front, with Facebook showing the capacity to deliver, but am afraid that I don’t share the euphoria with which some investors have greeted this news. Don’t get me wrong! Being successful in mobile media is critical to Facebook’s success but the revenues that I (and others) have projected for Facebook last year assume that success. So, the good news in the mobile media market keeps them on the forecasted revenue path, but failure would have been devastating.

- Management has matured: If there is good news that came out of the botched IPO, it is that the managers at Facebook (from the top down) seem to have learned two critical lessons. First, they no longer seem to be taking markets for granted and are taking the effort to explain not only what they are doing but why. Second, they seem to have realized that analysts and bankers don’t lead the market, but follow it. Nevertheless, the company remains a corporate governance nightmare, with voting rights concentrated in Mark Zuckerberg’s hands, but at least for the moment, he seems to be behaving more like a benevolent monarch than a malevolent dictator.

Incorporating the information in the last earnings report, I tweaked my valuation of Facebook and the word “tweaked” is used intentionally. None of the big news in the earnings reports represents significant departures from assumptions made in earlier valuation. The good news in revenue growth and operating margins was already being assumed and the fact that Facebook remains an advertising driven company puts limits on how big revenues can get. My estimate of value per share for Facebook has risen from $24/share at the depths of despair last August to about $27.65/share today (July 31, 2013). As always, you are welcome to download the spreadsheet and replace my assumptions with yours.

So, what now?

The old “buy and hold” advice, where we are told to buy good companies and leave them in our portfolios for posterity, makes little sense with growth companies, where markets often over shoot and under shoot. Last August, it was my belief that markets were over reacting to limited information in an earnings report from a young company and pushing its price down too much. Today, I believe that the markets are over reacting again to limited news from an earnings report and pushing the price up too much. As an investor who was lucky enough to buy last August, because the stock was trading below my estimate of its intrinsic value, I have to be consistent and sell, if the opposite holds now. The only pragmatic consideration that I have relates to taxes, since I will save substantially, if I can wait until September 4 to sell (when my gains will become long term capital gains).

So, what if you don’t own the stock? Should you sell short? I personally would not, since it is entirely possible that the momentum game that was so firmly against Facebook last year might work in the other direction now. There may be investors who will be drawn in to the stock if it crests the $38 IPO price, though there is really no economic or value significance around the number.

One final note. Even though I am selling Facebook, I will continue to follow the company. After all, the company may very well fall out of favor with investors in a few months and be back on my buy list. Bipolar markets are sometimes an intrinsic value investors best friend.

Leave a Reply