Ah, it seems like just yesterday President Obama bowed to King Abdullah, the leader of Saudi Arabia.

Back then the U.S. economy was just getting back on its feet. The Dow, S&P and Nasdaq were recovering from a massive series of pullbacks – and all-time highs were just a glimmer in the eye of even the most optimistic of traders.

But, alas! That was “way” back in 2009. Four years later the tides have turned …

Nowadays the financial markets are burning new all-time highs.

And more importantly the U.S. has begun and epic energy turnaround. We’re in the midst of the U.S. shale boom, ladies and gents.

Today when a Saudi oil sheik and a Texas oilman walk into a bar, the cowboy will buy the first round. And instead of bowing down to Middle East demands and high, cartel-driven prices, the U.S. is writing its own ticket.

Earlier this month I wrote to you about the tough road ahead for OPEC member nations. You see, with more oil and gas flowing from the U.S. and North America (along with down-trending demand), less OPEC oil is headed into Houston ports.

How much, you ask?

Well, get this…. U.S. imports of OPEC oil, in August 2008, tipped the scales at 6.3 million barrels per day (mbpd.) Today, according to the latest statistics from the U.S. Energy Information Administration (EIA), our OPEC imports have fallen by more than 50% — and currently stand at 3.1 mbpd.

Hmmm. Aug. 2008… Sure, it was the mark of the housing market collapse and the beginning of the 2008 market meltdown. But with a silver lining as our guide, we can jot that date down as “America’s turning point” against OPEC. Heck, with that EIA stat in mind the Texas oilman might buy the first TWO rounds at the bar!

This turning of the tide is just getting under way, too.

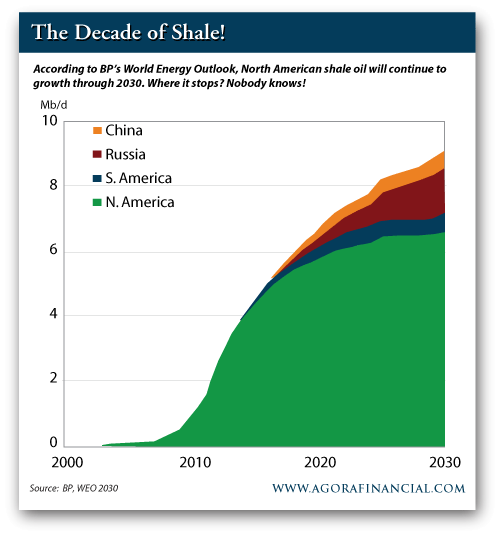

According to BP’s World Energy Outlook, OPEC’s market share of liquids (in the global market) is set to plummet between now and 2020 – that’s all thanks to the U.S. shale boom (in particular, an increase in U.S. petroleum product exports.) It’s the decade of U.S. shale oil!

According to the same BP study, the North American tight oil boom won’t peak until after 2030. Simply put, that means we’ll see continued pressure on OPEC’s market share.

Less OPEC oil and more North American shale production? It’s a broken record these days, but it’s playing our tune. Overall this trend is great news for the U.S. and North America in general.

And you guessed it, even the mainstream media is catching on these days. In another we-beat-the-street example, earlier this week the Wall Street Journal highlighted the U.S. oil boom’s impact on OPEC.

“The American energy boom is deepening splits within the Organization of the Petroleum Exporting Countries” the article says, “threatening to drive a wedge between African and Arab members as OPEC grapples with a revolution in the global oil trade.”

According to the same article the U.S. and Canada are set to produce 21% more oil by 2018, the International Energy Agency reports.

Truly, it’s only a matter of time before the mainstream catches on to my next forecast…

Oil Prices Are Still Due For A Drop

If, and this is a big if, the Middle East can remain solvent and out of turmoil we could be in for a decade of steady-to-low oil prices.

Low in this case would be $60-80 oil. It all depends on how these mega trends shake out, of course. But just from some back of the envelope math we know that shale producers can make money at $80 oil, same goes for $70… and then margins start to get thin around $60.

That said, there are only a few ways that this global oil market can shake out. As always, this physical market will come back to supply and demand. Right now we know there’s more supply hitting the market. It’s a Middle East and U.S. one-two punch.

Will emerging market demand come in and gobble up every last drop of the newfound, cheaper supply? We’ll have to wait and see.

For now, I’m betting on a short-term pullback in oil prices. Over the next 3-6 months I can’t see the oil market avoiding a drop below $80. Time will tell, of course.

One thing is for sure, if some of our favorite domestic producers go on sale with an oil price pullback, I’d be a buyer. Might be a good time to make sure you’ve got some dry powder.

Leave a Reply