I am just thinking out loud here. If the Fed can openly manipulate interest rates, bond prices, and equity markets, then why is it unable or unwilling to manipulate oil prices lower? After all, a decline in energy prices would significantly help the US economy in effect by creating a tax cut for consumers. Imagine if you only had to pay $2.00 a gallon for gas instead of today’s egregious $4.00 a gallon. You would have more money to buy all of those vital American necessities like IPads, flat screen TV’s, and other Chinese slave labor made products. All kidding there are many benefits to lower oil prices, including:

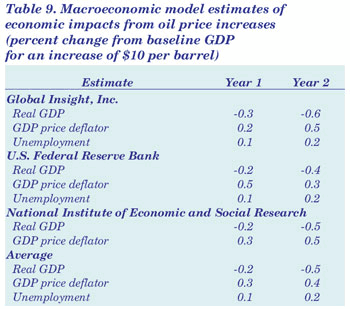

1. Increase GDP Growth—According to most analysts, a $10 rise in the price of oil lowers GDP growth 0.2-0.3%. This makes sense because higher oil prices act as a tax on the economy, lowering consumer spending and hurting corporate profits. Q1 2011, US GDP came in at an anemic 1.8%, which is far below potential and will do little to solve the unemployment situation. The main reason for such low growth is the rise in energy prices. Since September of 2010, oil prices have risen from around $75 to $113 a barrel. This has reduced GDP growth by over 1%, which is significant and costs will likely increase over time. However, if oil prices fell from $113 to a more reasonable $50 a barrel, the economy would could easily start to grow at a more healthy 3-3.5%. An economy growing at this rate would reduce unemployment much faster than current Fed projections.

Below is a chart showing the negative impact of high oil prices on GDP growth

2. Lower Inflation–While the Fed ignores food and energy from its inflation measures, there is no doubt that inflation is here and is negatively impacting the economy. Companies are forced to either absorb higher raw material costs (hurting profits) or increasing prices (hurting consumers). Inflation is also a sticky thing. Once it becomes embedded into an economy, it is very hard to reign it in. Just take a look at what Paul Volcker had to do to bring an end to the 1970’s stagflation. He had to jack up interest rates to 20% and cause a serious and deep recession. The point is that once inflation is out of the bottle, it is very hard to stop it from continuing. If the Fed simply brought oil prices back down to $50, it would significantly lower inflation expectations which pose a major risk to the US bond market.

3. Help Real People and the American Economy–lowering oil prices would benefit everyone, especially the poor and middle class who are struggling to survive record high commodity prices and high unemployment. By lowering the price of oil, it would make life a little easier for the Americans and increase consumer spending. The only problem is that the Federal Reserve has never given a damn about helping the American people. The reason is because the Fed is owned and operated by the major Wall Street and European banks which have diametrically opposing interests to the American people. The Fed was created by the banks to provide funding to them during financial crises. In effect, the Fed is nothing more than a taxpayer-backed piggy bank for the banks to suck dry. And best of all, there is no Congressional oversight of the Fed’s operations because it is a independent agency.

4. Decrease Speculation in Energy Markets–Over the last 5-10 years commodity markets have become dominated by speculators (mainly long only speculators). These speculators have caused massive market dislocations as can be seen by the price of oil from 2008-2011. Prices have gyrated from a high of $147 in July 2008 to as low as $35 in Feb 2009, all the way back to $113 in April 2011. There is no fundamental reason for these wild moves. It is simply a matter of speculators flooding the market and taking control of the price. If the Fed shorted oil prices, it would ruin many speculators who are betting on continuously rising oil prices. They would be forced to liquidate their long only positions.

5. For the Fed, Manipulation is Easy–The Fed can literally print money out of thin air (or at least electronically). This makes manipulation or targeting (the more politically correct term for manipulation) a simple task. All the Fed has to do is short oil futures until the price falls back down to a reasonable level (say $50). The oil market is much smaller than the US bond market, making the task of asset targeting much easier. The Fed would only have to short prices enough to force major speculators like hedge funds to liquidate their positions. This margin selling by long speculators would create a cascading effect as lower prices lead to more selling. The idea is that the speculators would do most of the work to bring oil prices down. The Fed would just have to provide the catalyst by starting the process. Whenever the dip buyers in oil come back to the market (boosting prices higher), the Fed will be there to ruin them and knock the price down again. The whole operation could be done for just a few hundred billion, a trifle compared to the over $2 trillion the Fed has already printed.

So the question is why has the Federal Reserve not simply shorted $50-100 billion worth of oil futures? Some may say that manipulating prices is wrong in our supposedly free market. But why is it all right for the Fed to control the bond market and interest rates? You can’t have both a free market and a central bank controlling the price of money. Since we obviously do not have anything nearing a free market, let’s just admit it and lower the oil price because it is harming the economy. One other argument is that the Fed does not have the authority to short oil futures. This is, in my opinion, an asinine point. Look back at the 2008-2009 financial crisis. Pretty much everything the Fed did during this period was illegal. From bailing out insolvent banks to lending money to foreign institutions (including the central bank of Libya) the Fed has shown that it is above the law in all respects. So let’s be reasonable and agree that the Federal Reserve is not bound by any law. All that is required by the Fed, is a meeting where they declare a crisis or emergency and they can pretty much exercise and powers they wish.

Of course, the Fed would have to keep the price manipulation a secret because it would upset major oil producing countries like Saudi Arabia and Russia. The good news is that the Fed is highly capable of keeping secrets from the public so they should not have any problems in this respect.

So come on, Zimbabwe Ben, you have illegally spent trillions bailing out your bankster overlords, so why not help out the average Joe by shorting a few hundred billion worth of oil contracts?

Disclaimer: This page contains affiliate links. If you choose to make a purchase after clicking a link, we may receive a commission at no additional cost to you. Thank you for your support!

Not a bad idea however have you bothered to consider that perhaps the Fed has already done what your saying ?

Just perhaps the current prices are the result of a significant short position held by the Fed.

If so then where are oil prices eventually going if the Fed has already taken a substantial short position ?