Here is a follow up to my previous post about what to expect when Quantitative Easing is reversed. The point I made earlier is that the more likely scenario for tightening of monetary policy is that this will happen when growth gets stronger. Krugman makes the same point in his latest post. But I can also see plenty of articles talking a much more pessimistic view and describing all the bad things that will happen when central banks change their current monetary policy stance from expansionary to neutral, including a large downward adjustment to stock markets. I am surprised that there are very few historical references in those articles, so let me produce two to refresh our historical memory.

What has happened to the stock market in previous cycles after the central bank decided to abandon its policy of low interest rates and start raising those rates? I will use US data and I will focus on the last two episodes:

1. After the 1990 recession, interest rates remain low until February 1994 when the Federal Reserve started increasing rates from a level of 3% to 6.6% in May of 1995.

2. After the 2001 recession, interest rates were lowered to 1% and then started to increase in June 2004 from that level to 5.25% in June 2006.

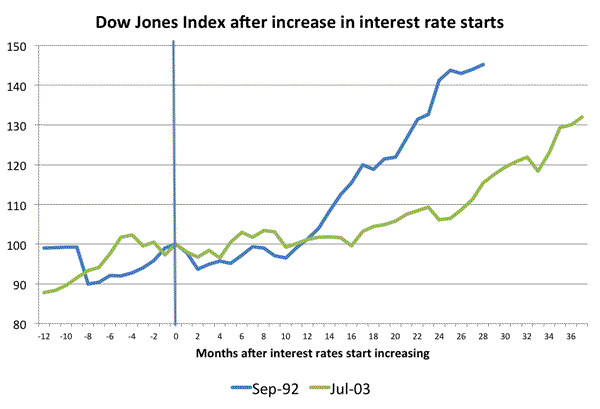

The image below plots the evolution of the stock market in the months that followed both episodes. The Dow Jones Index is rebased to be equal to 100 the month when interest rates started going up — I also provide the previous 12 months to get a perspective on what happened during the previous year. [Note: I stop the series when I see interest rates declining again as growth slows down in 1997 or as we enter the recession of 2007.]

As always it is hard to know what the market was thinking during those months. We clearly do not see a fall in the stock market in any of the two episodes, we seem to see a period of wait and see while interest rates are increasing but once interest rates stabilize we see significant booms in stock prices driven by the positive economic dynamics (high growth) that drove interest rates up in the first place.

Leave a Reply