As reported by the financial press, the stock market continues to hit fresh record-high levels in many advanced economies. The Dow Jones passed the 15,000 mark, the Nikkei just went over 14,000, and the DAX just went above its previous record. It seems to be the time to talk about bubbles in asset prices – an important issue given how these bubbles have dominated the last business cycles in these economies.

Except that we are looking at the wrong numbers. It is remarkable that the discussion on the value that these indices are reaching ignores two fundamental issues:

- These are nominal values and as we were told in the first economics lesson, we need to look at real variables and not nominal ones.

- Asset prices are not supposed to stay constant (in real terms). In many cases its appreciation will reflect real growth in the economy, earnings and/or the expected return that these assets should provide in equilibrium.

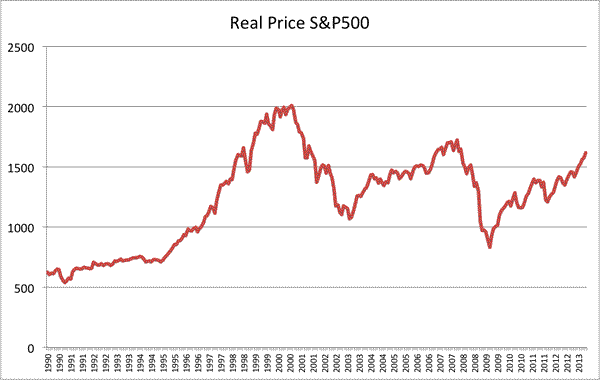

No need to look for data that provides a better benchmark than just nominal indices. Robert Shiller provides all the necessary data in his web site. Adjusting for inflation is easy and below is a chart with the real price of the S&P500 index where the CPI has been used to convert nominal into real variables.

After adjusting for inflation we can see that the index is far from its peak in 2000 and it is even below the peak in 2007. No sign of a record level yet.

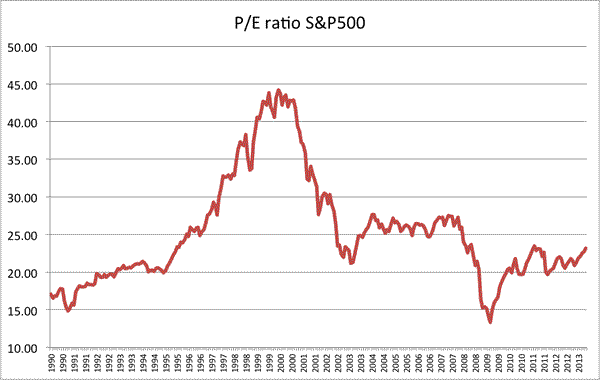

Adjusting for inflation is not enough as the fundamentals (earnings) also grow because of real growth. The price-to-earnings ratio takes care of this adjustment (it also takes care of inflation because earnings are measures in nominal terms). Making this adjustment is more difficult but I will reply on Shiller’s numbers again (his book and writings provide a lot of detailed analysis on his data).

Once we adjust for nominal as well as real growth, the current levels look even less impressive. Very low compared to the bubble built in the 90s and significantly lower than the ratio observed in most of the years during the 2002-2007 expansion. We are very far from record-high levels if we use this indicator.

Of course, to do a proper analysis we need to bring a lot of other factors: expected earnings growth, interest rates, risk appetite,…. And there will be room there to debate whether the current valuation of the stock market is reasonable, too high or too low. But starting the analysis with a statement of record-high levels when measured in nominal terms and ignoring real growth in earnings is clearly the wrong place to start the debate.

Leave a Reply