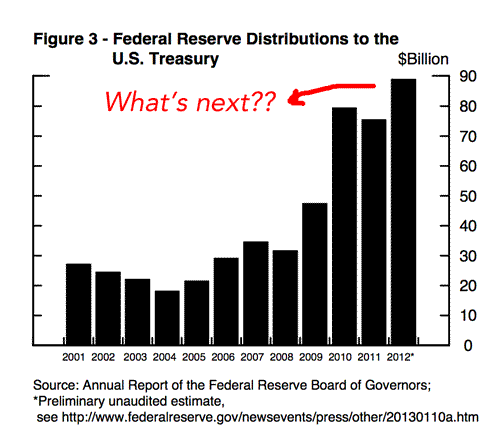

The Federal Reserve makes a ton of money on its $3T horde of government bonds. In 2012 the Fed earned a tidy $90B by borrowing short and lending long. That income number is the difference between interest income and expense. The P/L does not reflect the fact that the Fed as a huge unrealized gain in its portfolio (The Fed takes capital gains and losses only when securities are sold). According to a recent Fed report, the Fed is sitting on unrealized gains that are in the neighborhood of $200B.

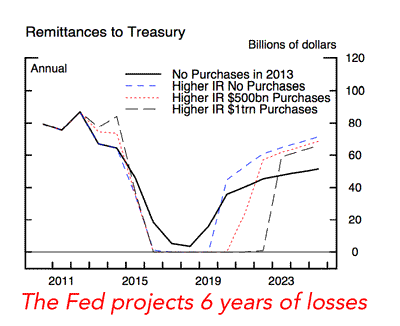

This chart shows how big the Fed’s contributions to Treasury have been over the past few years. The Fed’s net income has cut 10% off of the annual deficit.

The question that hangs in the air is what happens if interest rates were allowed to “normalize”. Fortunately, there is an answer to this question. The source of this information is interesting, it comes from the Federal Reserve.

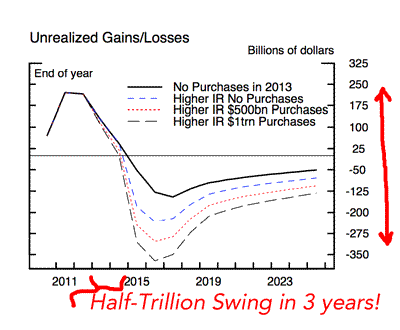

This is a technical report and covers many “what ifs”. One critical variable is what will the Fed do in 2013. That has been answered, the Fed has done QE#4 and will grow its balance sheet at the rate of $85B per month. This result is reflected in the red-dotted lines in the following charts.

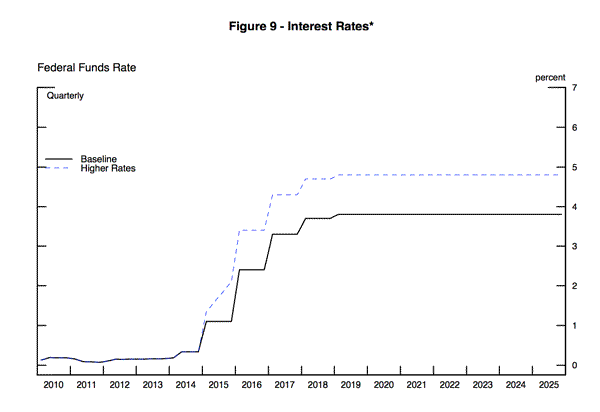

First a look at the interest rate assumptions that drive the results at the Fed:

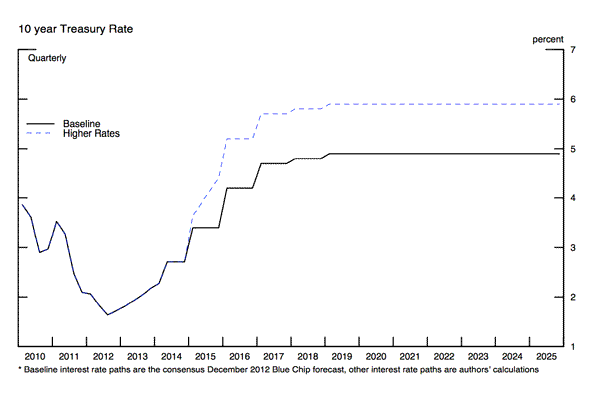

On the assumption that those rates will be the reality, this is what would happen to the Fed’s income statement:

Note that in all cases, the years of $80b Fed gains are over. Note also that if interest rates do rise, the annual return to Treasury quickly falls to zero, and actually goes negative (loss).

The Fed’s balance sheet would get crushed (on a mark-to-market basis). The $200B of unrealized gains would fall to an unrealized loss of $300B. A half-trillion dollar swing in just a few years.

Let’s say it plays out like this. What does it mean if the Fed has annual losses, and a big hole in its assets? The answer is, “Not much”.

– The annual remittances to Treasury would fall to zero, That would, by itself, add to the deficit. The magnitude of the change (-$80b) would not be that big an issue.

-If the Fed takes an annual loss, an accounting “asset” is immediately created equal to the loss. The asset would be in the form of a future claim on remittances to Treasury. This is an accounting gimmick.

If the Fed had a $50B loss in year #1, a $50B Deferred Asset is created. If in year #2 the Fed has a$50B profit, the money is first used to reduce the Deferred Asset. If you believe that the Fed will earn a profit over time to offset current losses, then the Fed can never be consider insolvent.

This is the Fed’s explanation of the magical accounting:

The deferred asset is subsequently realized as a reduction of future remittances to the Treasury. Thus, it is an asset in the sense that it embodies a future economic benefit that will be realized as a reduction of future cash outflows.

The Fed goes on to defend this (flaky) logic with:

This accounting treatment is consistent with U.S. GAAP and is similar to the way that private companies report deferred loss carry forwards as an asset.

Well, that is “sort of” correct. This situation can arise with a private sector company. Tax loss carry forwards are an asset. But they are an asset that analysts look askance at – for obvious reasons.

The Fed is not just the Central Bank. It is a regulator for the nation’s biggest banks. If one of those banks tried to use a $100B tax loss carry forward as an asset, the Fed would put the screws to them. For example:

-The Basel II capital requirements specifically exclude Deferred Taxes as a qualified asset. (So how can the Fed treat it as equity?)

-The Fed has restricted Citi from stock buy-backs and dividends because the bank has $50B in Deferred Tax assets on its books. (Good for the goose, but not the gander?…)

Note: This is an odd report to be coming from the Fed. What to make of it?

I put it on the growing list of “things” that are suggesting that the Fed is pondering a change in direction. If there are any ‘tea leaves’ in the analysis, they would read that QE is going to be ending pretty soon.

The Fed is aware of the risks it is taking. The report quantifies the risks in an orderly, but scary way. The fact that this report exists, confirms to me that some Fed members are increasingly uncomfortable with those risks.

Leave a Reply