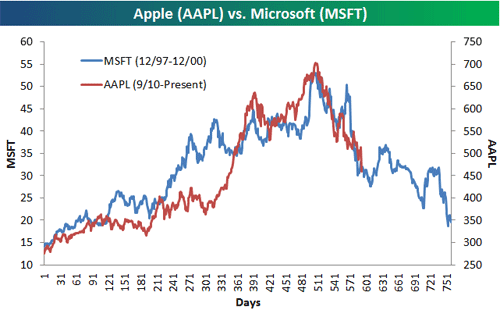

By now it is clear Apple (AAPL) has fallen off a cliff after a parabolic rise. History says the fall will at least retrace the parabolic rise. We saw this recently with Crude Oil rising over several years into a parabolical peak at $147 (cash price), then falling in six months to $31 before bottoming. We saw this in 2000 with a bunch of tech stocks, and in particular the leader at the time, Microsoft (MSFT). Is AAPL, the leader in 2012, replicating MSFT, the leader in 2000? The charts are eerily similar (courtesy Bespoke):

History also says a bull trap will emerge on the way down, a major bounce where many think they have caught the bottom, but when it reverses, they instead get sliced & diced as if grabbing a falling knife. Same bulltrap happened to crude on its rapid drop. The AAPL false bottom may have already occurred around $500 (see chart). After bouncing at that level, it has hit an airpocket and now seems on a bottomless journey down. A scan of the punditry finds some expectation for a bottom at $410, and I expect that level to catch some bids, but a look at the chart (red line) shows no support level until AAPL gets to the start of the parabolic spike up, at around $350.

Apple is a quality company, and its recent miss seem to be more an anomaly of comparing a 14 week quarter a year ago with the 13 week quarter that recently ended than a sudden break in Apple’s trajectory. Hence, at some point, a bottom will be found, and a buying opportunity discovered; the bigger question is whether, like Microsoft’s lost decade, will Apple grow quite strongly but never regain the recent stock highs? Maybe there is an app for that …

Apple is so much better off than Microsoft. The author neglects to mention Microsofts P/E was around 75 at it’s peak, apple’s was only 15 even when it peaked at 700. So if you adjust the fall based on P/E MSFT would have fell from about 37 to 31 to adjust for Apple’s current P/E of 9. Also MSFT had no where near 137 billion in cash with zero debt in 2000. Also Apple makes both the hardware and software, and it has many more revenue streams than Microsoft. Iphone, Ipad, Imac, Ipod, Itunes, Icloud, etc.. Customer loyalty is only enhanced by the iphone and iCloud ecosystem, and once you are in the Apple realm it’s almost impossible to turn back unless you want to lose 5 years of your life. Add on Apple Television coming out this year (if they can get the cable deals done) and you have yet another revenue stream in the 20 to 30 billion/year range. The problem is the stock market has never seen an apple before, so they question how high it can go. This article is entertaining, but make no mistake, apple is like no other stock the market has ever seen.

5 months ago analysts were predicting highs of $1000/share. Now we get low-ball porn below $400 because… AAPL is maintaining it’s industry dominance. O…K…

Who’s supposed to be causing AAPL agita? Samsung? From a commercial campaign based on a single app (Bump technology) that existed prior to the iPhone 3G? Which has been available for iPhone users for that entire period of time? With which Samsung had nothing to do concerning it’s development? Yet Samsung is now making the hallmark of it’s pitch to users priced out of the AAPL market. Even though. their phone has lower resolution and a slower chip, and god knows what kind of data managing technology under the hood which users will depend upon to find and access all their stuff. I see. So because of this and Google Maps, AAPL has gone into an unrecoverable free fall. O…K…

Make no mistake, AAPL is sitting on huge hordes of cash. If any industry competitor (including cable companies) came along to threaten their position they would simply buy them. I feel bad for people who were planning to cash their AAPL stock this year to pay for college, but otherwise I think AAPL’s got it covered.

Talk about selling “old” technology… look at Apple. Whats old is new again if it comes out on an Apple. Just slap an “i” in front of it and it will sell. Panoramic picture… My Android had it long ago. Oh. look I have an app that can “Name that song”…. Had it years ago on a Sony/Ericsson bar type phone even before the iPhone was out.

Apple has sharp looking products that works well, if you like being trapped into doing things their way. Apple has always been about marketing and presentation and with the loss of Steve Jobs they have lost that. They need that guy out there to excite their iPeople. That will sell product.

Comparing a software company to a hardware company is not a valid comparison. Obviously a software company will always have a way higher pe than a hardware company.

Samsung’s Nexus 10 tablet has not only better hardware but better screen resolution than the iPad.

Most new Android phones, including those made by Samsung, have equivalent screen resolutions to the iPhone. Most Android phones have had and continue to have better hardware.

Android is an OS that constantly improves to look better and be more useful. Meanwhile, iOS looks the same in 2013 as it did in 2007.

Search for video comparisons of Google Now vs Siri, and you’ll see Siri is not even on the same level. Apple had the upperhand in many areas of the smartphone market, but complacency has cost them dearly.

Where do you get your information??? You should try keeping up with tech news and consumer opinion and maybe then you would have seen this coming like many of us did. We knew it was coming; it was just a matter of when.

Being ignorant of the world around you doesn’t make what you say right; it just makes it a delusion.