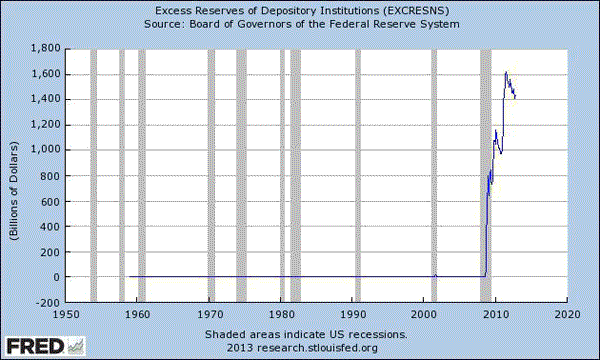

Keep this one on your radar. Excess reserves of depository institutions are beginning to decline, down $183 billion, or 11.3 percent, from their peak in November 2011

This is where much of the Fed’s money printing or balance sheet expansion has gone since the beginning of the financial crisis. The Fed injects liquidity through its asset purchases and the financial institutions deposit the proceeds right back at the Fed in the form of excess reserves, which now pays interest.

We believe if excess reserves are declining, it may signal the massive liquidity created by the Fed over the past few years is starting bite and beginning to leak into the economy as credit expands. When the economy begins to accelerate the leak could turn into a flood and that is what, we think, some at the FOMC fear. That is, the excess reserves turning into high powered money.

Could be wrong, but at least that’s how we see it.

Leave a Reply