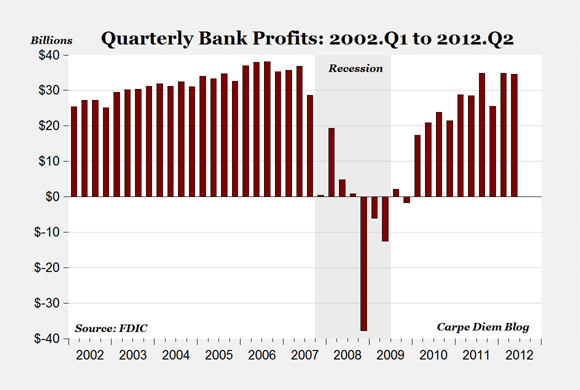

The FDIC released its Quarterly Banking Profile today for the second quarter, here are some highlights:

1. U.S. banks earned a total of $34.5 billion from April through June, a 20.7% increase compared to Q2 2011 (see chart above). Almost two out of every three (62.7%) of the 7,246 FDIC-insured banks reported higher earnings than a year ago. Only 10.9% were unprofitable, down from 15.7% in Q2 2011. The increase in profits was the 12th consecutive year-over-year increase in quarterly net income for U.S. banks starting in Q3 2009, following ten consecutive decreases from Q1 2007 to Q2 2009.

2. The $69.3 billion bank net income for the first half of 2012 was 21% above the same period last year, and highest profits for January-June since the $72.5 billion in 2007, five years go.

3. Banks set aside $14.2 billion in provisions for loan losses in Q2, a 26.2% decline from Q2 2011, and is the smallest quarterly total in five years.

4. Net loan charge-offs (removed from balance sheet because of uncollectibility) totaled $20.5 billion in Q2, an $8.4 billion (29.1%) reduction from Q2 2011 and is the eighth consecutive quarter that charge-offs have declined from year-earlier levels and the lowest quarterly charge-off total since Q1 2008. All major loan categories posted lower charge-offs compared with a year ago.

5. Noncurrent loan balances (loans 90 days or more past due) declined for a ninth consecutive quarter, falling by $12.9 billion (4.2%). Noncurrent levels fell in all major loan categories.

6. The number of institutions on the FDIC’s “Problem List” fell for a fifth consecutive quarter, from 772 to 732. Total assets of “problem” institutions declined from $291 billion to $282 billion.

7. Fifteen banks failed during Q2 (following 16 failed banks in Q1) which is the lowest number of failed banks in a quarter since 12 banks failed in Q4 2008.

MP: Overall, this is a very positive report for the financial conditions of U.S. banks in Q2: profits are strong (+20.7%), provisions for loan losses are at a 5-year low, net loan charge-offs fell by 29% in Q2 to a four-year low, noncurrent loans declined for the 9th quarter, the number of “problem banks” fell and the number of failed banks fell to a three- and-a-half year low. Along with a gradually recovering overall economy, U.S. banks have gradually recovered and the financial health of the banking system has returned t0 pre-recession conditions.

Leave a Reply