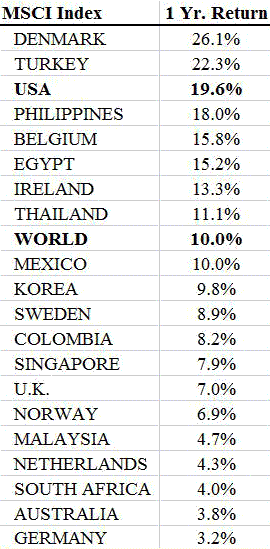

With all of the bad news coming out of Europe, and the ongoing gloom and doom in America with predictions of a pending double-dip recession, it might be counter-intuitive that some stock markets have actually registered impressive returns over the last year, see the table of one-year returns based on MSCI data that includes both developed and emerging markets. Denmark leads the list with a 26.1% return over the last year, and other European stock markets like Belgium (15.8%) and Ireland (13.3%) have achieved returns higher than the world average over the last year of 10%. Of course one-year returns in markets like Greece (-52%), Portugal (-33%) and Spain (-24%) have been pretty dismal, but it’s not like the entire continent is doing that poorly.

With all of the bad news coming out of Europe, and the ongoing gloom and doom in America with predictions of a pending double-dip recession, it might be counter-intuitive that some stock markets have actually registered impressive returns over the last year, see the table of one-year returns based on MSCI data that includes both developed and emerging markets. Denmark leads the list with a 26.1% return over the last year, and other European stock markets like Belgium (15.8%) and Ireland (13.3%) have achieved returns higher than the world average over the last year of 10%. Of course one-year returns in markets like Greece (-52%), Portugal (-33%) and Spain (-24%) have been pretty dismal, but it’s not like the entire continent is doing that poorly.

Some of the Asian markets like the Philippines (18%), Thailand (11%) and Korea (9.8%) are doing quite well, and one-year returns in the U.S. of almost 20% (and 15.5% per year over the last two years and 11.4% per year over the last three years) place the U.S. as the No. 3 stock market in the world over the last year for this group. And the one-year return in the U.S. over the last 12 months of almost 20% is almost three times the 7% average annual return over the last 60 years, and twice the world stock return over the last year of 10%.

Note: The S&P500 is up by 19.8% over the last year and the NASDAQ has gained 24.4%.

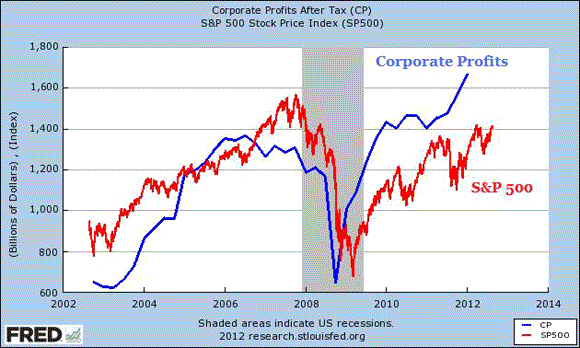

Update: The chart below shows corporate profits after tax (through Q1) and the S&P 500 Index (through August) over the last ten years (data here). One of the main drivers of stock prices is corporate profits, and one of the main reasons stocks have gained almost 20% over the last year is probably because corporate profits are at record high levels (at least through Q1).

Leave a Reply