The News out of Europe about the Spanish Bailout concerns as many people as it excites! Our world continues to reward failure, but as far as the markets go, it excites those that think the forces at will are being a bit more proactive and will do whatever it takes to keep the Euro zone together–for now. It excites those that think over time, the Union will take on different sizes and shapes, but will ultimately stay together in some form. Does Greece get a bit of a re-work to keep them quiet as their elections will come and go? When does Italy need its package. There are lots of very complicated questions that those with opinions think they have answers for, which becomes a dangerous game.

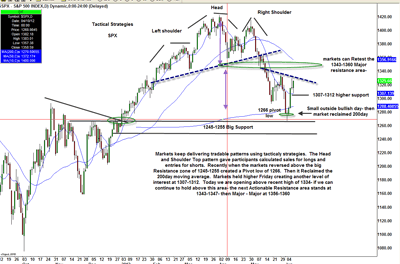

Futures are up about 12-15 handles, but are well off last night’s excitement highs. If you didn’t buy/test longs when the S&P reclaimed the 200day around 1285 on June 6th, or if you didn’t’ nibble into Friday’s gap down as the top third of recent lower range around 1307-1312 held. You really have no business chasing and initiating longs into this gap up, even if it turns into a “gap and go”. On the same token, if you’ve rolled up shorts with opinions, and not based on tactics, your thesis must be strong with big risk tolerance.

The May 9th pivot low is sizeable resistance to use as an action area. This stands around 1343-1347, maybe the market tests it today. I think it’s a better sell into this area than buy. Major resistance stands where the 100/50-day curl down as well as the old neckline of the Head and Shoulders top that stands around 1356-1360. If the markets reclaims this spot in coming weeks, the most committed Bears will need to cover.

(click to enlarge)

Also remember, over the last two Summers, markets had five to seven 70-120 handles moves in both directions before a sustainable direction was picked (which were both 4th Quarter rallies). In other words, buying after a 60-70 handle upside move didn’t prove profitable, as well as shorting after a 60-70 down move.

Lots of stocks had nice oversold bounces, but only some are investment quality for macro/longer term guys. Stocks that held above the 100day as indices went to or below the 200day are the ones that should be on your radar as macro longs or investment quality names. Those below all major moving averages are ones to be sold until they get reclaimed and prove they can hold higher.

I do think that if you want to be long stocks for a move later this year, you can do so from lower prices than you see on this gap up.

Disclosure: Scott Redler has no positions

Leave a Reply