Facebook: Fakebook, FailBook, FacePlant, pick your favorite euphemism for the epic fail tepid offering on Friday (it hasn’t failed, yet, although perception here seems to have become reality – no pop, fail). The first half an hour of trading was a mess, and some retail trades ordered right away didn’t get filled until after hours. Amazing.

Facebook: Fakebook, FailBook, FacePlant, pick your favorite euphemism for the epic fail tepid offering on Friday (it hasn’t failed, yet, although perception here seems to have become reality – no pop, fail). The first half an hour of trading was a mess, and some retail trades ordered right away didn’t get filled until after hours. Amazing.

Whatever plagued Fakebook (FB) also impacted a plethora of other tech stocks, including ZNGA, AAPL, NTFX, and INTU. Zynga in particular had a wild drop followed by a trading halt before recovering a bit. ZeroHedge’s foresenic analysis concluded that software hammered the social software’s IPO – software errors in the exchange routing systems.

The NASDAQ head defended his software this morning in the NYT, claiming his system didn’t cause the stock to decline. He blamed order cancellations for the trading delays. I guess he doesn’t realize that the glitch led to trading confusion, which caused the brokers to back off selling to their retail investors, who then stood aside. So, does he believe that a slackening of buy orders didn’t contribute to the decline?

First lesson: FB would have been better off listing on the NYSE.

The expected first-day pop failed. Was this due to routing errors, gross over-pricing, or human mis-judgement?

A lot of the tech press blames the greed of insiders, who upped the amount of shares they could sell in this offering by a whopping 25% of the offering. Or the underwriters, who let it happen. Sy Harding has a more prosaic view, that Zuck’s desire for advantaging the retail investor screwed up the normal process. There is also the Goldilock’s view, that the offering ending flat means it was priced just right.

I think all these factors had an impact. Some whisper numbers suggested the institutions would have been happier at $36 not $38; and I suspect that when they got pushed aside for more retail investors, they had less incentive to play for the first-day pop (where they sell off some of their position for a quick skim). Worse, letting the enthusiastic retail investor in early removed the piling-on that drives a first-day pop. For the savvy retail investor, if you can get a piece of a hot offering, the offering ain’t so hot.

Second lesson: there is a reason IPOs are done a certain way, and it isn’t all greedy bankers. Google tried to change it, and got a tepid offering. Perhaps the same occurred here. Stocks are not like normal commodities, in that they increase in perceived value as they rise, whereas as normal stuff sells more when it goes on sale. BTFD.

Thanks to the greenshoe, the underwriters most likely have avoided taking a bath. They came in to support the stock at $38. A Reuters piece, widely linked, estimated the potential cost was $2B, well in excess of the potential profit on the offering – indeed, in the JP Morgan derivatives “London Whale fail” level of a huge loss – but this reflects a common misunderstanding of the mechanics of an IPO. (Take a gander at this ‘evil banker’ sort of post on the economics of an IPO that exaggerate the upside and overlook the potential downside.) The greenshoe allows them to float an additional 15% in a hot offering – a potential profit enhancer – but also allows them to buy back shares in a cold offering as this one turned out to be. In effect, the ‘shoe gives them a 15% short position which they can apply against buying back shares without cash. (And Reuters persisted with its misleading reporting even after the greenshoe was explained to them.)

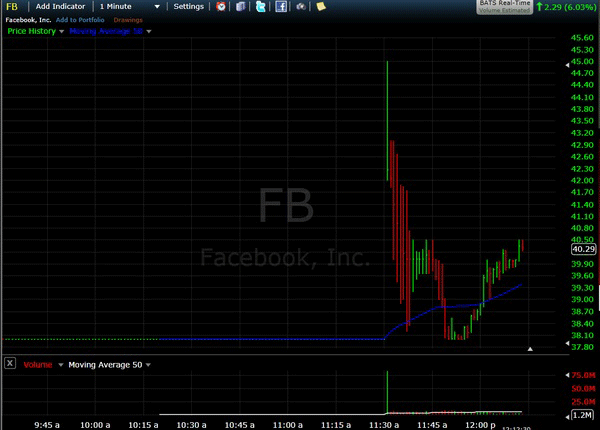

Various investigations will sort out what went wrong. Fundamentally this is such a large float that the sort of first-day pop should not have been expected – even though the people-in-the-know almost universally expected a pop. I must confess, I too got caught up in the excitement; I thought it would open at $44, be driven down near $38 and then rise above $44 to end the day around $48. It did open around $44 – some services have it at $42.99 (WSJ), others at $45 – but of course it never climbed back above those levels. You can see the opening action in this chart:

Third lesson: Man is a herd animal. That is why we get booms and busts, bubbles and depressions.

The biggest fallout of this IPO may be that it will not take the place of Apple in 1980 and Netscape in 1995 – the IPOs that rang the bell on the subsequent tech booms. Instead, it is more of another Google, a seminal offering that did not spark an early Web 2.0 boomlet. You can see a comparison to AAPL, MSFT, GOOG and AMZN in this cute infographic.

My take: FB waited too long to go public.

Fourth lesson: It should have gone IPO in 2009, while it was still in the big growth stage. THAT would have been one glorious pop! And a lot of the value would have flowed to the retail investor, not just the insiders and institutional investors, as they would have caught the great 10x rise from then to now.

I do not expect the FB IPO to put a damper on the upcoming onslaught of other social mobile web IPOs. There are about the same number of $1B+ valued private social companies as public ones, and most will attempt to get public over the next 18 months.

Think of the pop that didn’t happen as the proverbial dog that didn’t bark. FB got out at a huge valuation! It now has a huge cash hoard to go roll-up the industry and solidify its tremendously advantaged position. It will spawn thousands of local millionaires, and they will become a new hoard of angel investors to increase the entrepreneurial fervor that has gripped SF and NY.

Final lesson: Don’t confuse buying a stock with buying a company. Facebook is stronger after their IPO, much stronger, even if the stock weakens.

I think every investor just sees right through this “company”. If it plans to generate revenue through ads it didn’t help that a huge US Auto manufacturer dropped it the week of the IPO. Also, take a look at the user numbers by country. 157 mm US then a slew of other countries. 1 million users in…Iraq and Nepal? How many companies plan to advertise there? And at what profit for FB? Time spent on site is down, people don’t like the new layout, Twitter is on the rise…IPO failure.