The economy is looking better, with growth in employment, retail spending, and manufacturing production. Will the economic recovery spread to real estate? Some good news has already arrived, but not enough to make most real estate professionals happy. Things are getting better, but it will be a while before everyone is feeling good again.

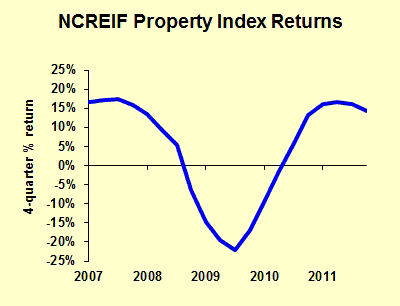

Investors in real estate are feeling better already. The NCREIF index, based on investment properties owned by major institutions, provided a 14 percent return last year, beating stock and bond indexes. The NAREIT index, covering real estate investment trusts, returned eight percent, a healthy gain in this investment environment.

These returns are driven by improving fundamentals. In offices nationally, net absorption of space far exceeded new space brought to market, resulting in falling vacancies. Industrial new completions are also below absorption. Retail space is the exception to this pattern, with absorption running roughly in line with new completions, resulting in the vacancy rate remaining elevated.

The government statistics on non-residential construction showed a little improvement over the course of 2011, mostly from power plants and manufacturing facilities. These are nice for contractors but do little for real estate brokers or investors or financiers.

The outlook for operating earnings is positive. As the economy improves, occupancy will increase. Rent concessions will be cut first, then asking rental rates will rise, putting landlords in the catbird seat. This process will happen gradually over the course of 2012 and 2013. Two years from now, property owners will feel comfortable.

Owners usually should get nervous about new supply coming in to take away their tenants. Right now, however, there is very little construction activity, and that which is occurring is mostly build-to-suit. The real good times for property owners are over a year away, but they’ll be especially good in the sectors with long construction lead times, such as downtown offices. Suburban warehouse space and other property types that can be built rapidly will benefit the least, though even these sectors will see some good times.

Limiting current construction are tight lending standards. Even though projects are beginning to pencil out, lenders now realize that property values can go down as well as up. They are requiring more equity than in years past, which limits plenty of developers who struggled in the hard times.

Non-residential contractors can expect better times, but not for a while. Look for a real rebound in activity late in 2013 and into 2014.

On the residential side of real estate, apartments are already looking good. Vacancy rates are down, rents are rising and new projects are breaking ground. Given that it’s about the best play in real estate today, there’s a risk of going overboard, which is a long tradition in real estate development.

Single family home prices are have probably hit bottom, though a brisk upturn is unlikely any time soon. The percentage of detached housing units that are vacant is still high, so new construction is not warranted except in specialized niches. With improving job markets, demand for houses will improve over the course of 2012. Some families are already seeing favorable buy-versus-rent comparisons, and more young adults will be moving out of their parents’ homes, pushing rents up even more. That will absorb the current excess supply, and we’ll start building more houses in 2013—not anything like in the boom, but moving toward a reasonable annual rate of production.

The recovery has come late to real estate, but it will come.

Leave a Reply