I’ve been trading the casino stocks as a group since I first spoke about them breaking out back in March of 2010. They provide tremendous opportunity from an active trading perspective.

Traders love when stocks trade as a group, when you can look to other stocks in the same sector to give clues to speed and composure. Sometimes stocks can develop long-term trends to swing trade with, while sometimes they are just great cash flow trading vehicles. The casinos have been both over the past few years. The composure changes over time, leadership changes within the group, and these divergences can be uncovered using technical analysis.

The three major stocks that I trade in this group are: Las Vegas Sands (LVS), Wynn Resorts (WYNN) and MGM Resorts (MGM).

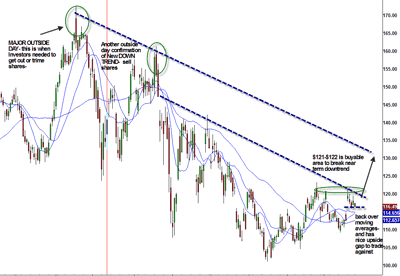

Until July 19th of 2011, Wynn (WYNN) was the clear class of the group. (The leader of these Three Amigos, if you will.) The composure changed when it had an outside bearish day that gave technicians a major red flag. This technical pattern always makes me say “take profits”, as they are often topping signals.

This topping pattern was then confirmed with a lower high on September 20th, which was also an outside day. If you didn’t sell your WYNN on this first clue, this was your second opportunity to lighten up as the trend changed. WYNN lost its leadership status on that day.

(click to enlarge)

Las Vegas Sands (LVS) is now considered the alpha leader of this group. It’s above all moving averages and just cleared an almost two-year consolidation. Stock has been behaving much better than WYNN and it has recently been a better investment than a trading vehicle. As long as this stock stays above the prior $50-51 channel break (it cleared $54 today for momentum after we listed it in Off the Charts last night) it should see a move to the $65-68 area. This is the measured move of the pattern.

(click to enlarge)

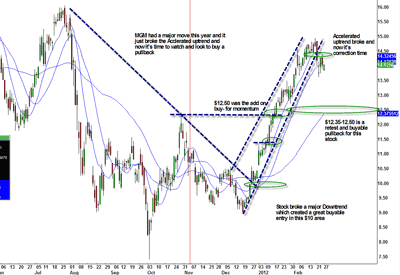

Typically MGM Resorts (MGM) is the tail of this three-part animal that wags when the lead dog is barking. Since December, it has actually acted much better with a mind of its own. This stock had about a 40% move through its downtrend and is currently in pull-back mode. It broke its accelerated uptrend that tends to give way for a retracement. I think the $12.30-$12.50 area is the line in the sand and should be buyable moving forward. The aggressive investor might nibble vs. today’s low of $13.40, but it’s back in “prove yourself” mode.

(click to enlarge)

Although these stock usually move as a group, they Provide different opportunities at different times based on the technical’s and complexion of the chart pattern.

WYNN just had a major news announcement that might have paved the way for better action. There is trading opportunity here. The stock has a Pro gap that’s unfilled, which shows demand for those shares. As long as it continues to hold the gap an trades above $114-115 area, I see a juicy trade developing if it can start a new trend. The buyable area is $120-122.

Wait for it to clear the downtrend/trigger buy price. Sometimes if you don’t wait for the pattern to trigger, you have to sit longer before it gets in motion! Then the next big resistance, the major downtrend that was started back on that outside day, stands at around $132-135.

Here’s a summary of the complexion of the group.

LVS is considered the strongest and a cleaner investment vehicle. Watch this stock for leadership moving forward! Above $54 gets you $65-68, in my opinion.

WYNN has been trapped in a downtrend since it’s outside reversal top, but is on traders’ radars for this to change above $120-$125, with a first stop at $130-$135.

MGM is in pullback mode and should be buyable in the $12.30-12.50 range. Aggressive buyers can nibble vs. today’s low of $13.40. I do think buying this pull back and putting in the drawer for what could be a bigger move later this year.

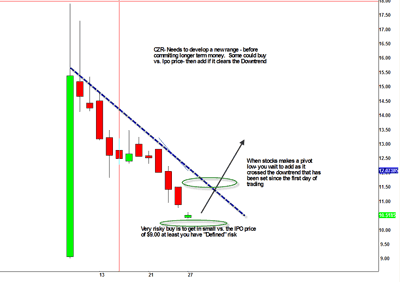

As a bonus nugget, Casears (CZR) was an IPO that came out on February 8th. There is an art to trading the first few days as active traders, but now it’s time to take a look at it from more of a swing trading perspective. This stock peaked out at $17.50ish and has trickled lower down to almost the $10 area. Typically I like to see 4-6 weeks go by, or sometimes 4-6 months depending on market environment, before we look at the longer-term.

(click to enlarge)

Some very risky investors might want to nibble small vs. the IPO price of $9.00. This defines your risk, then add when it starts working, which I am defining as when it crosses it’s downtrend and creates a new buyable pattern of higher lows and higher highs. This might happen if stock gets above and clears $13-13.50, but we will have to watch for that at another time. Buying into this dip is just a feeler to get you committed and acclimated to how the stock moves.

Disclosures: Scott Redler is long SPY, OIH, IBM, INTC, JPM, MMM, BA, LVS, AAPL, NUAN, CSCO, BAC. Short DIA QQQ.

Leave a Reply