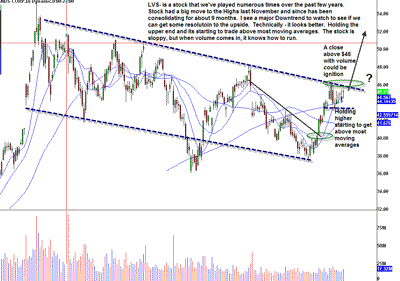

Las Vegas Sands Corp. (LVS) is a stock that we had a lot of fun with a year or so back, as it ran from $19 to almost $40. The stock peaked around $55 in early November. Since then, the stock has been basing and creating a 9 month channel. There have been lots of false micro moves along the way with some sloppy action. This usually occurs as a stock absorbs a big move.

The casinos acted very well during this market pull in with Wynn Resorts Limited (WYNN) by far the best in breed. I know it sold off on earnings but it was extended in price. Technically, LVS just held in the upper end of the channel and is now above most it’s moving averages.

You can trade this two ways. If you see a high volume move and close above $46 it could ignite to the upside. You could buy tier one now, and add through that level but you might need to sit through earnings in late July. Or you can buy some August $46 calls for about $2 dollars and eliminate the noise and quantify your risk. If this goes, we probably see a move above $50 so it will more than cover the premium paid.

Disclosure: Long LVS

Leave a Reply