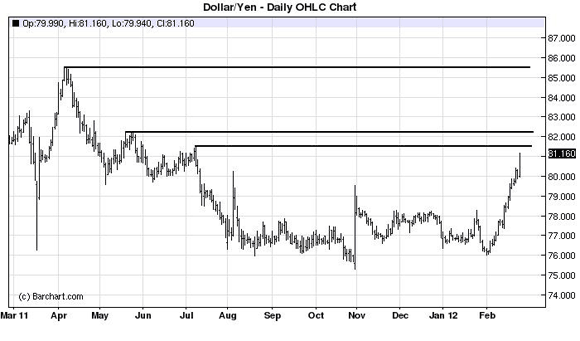

The Yen got hammered again this week breaking through almost all technical support and looks to at least test last years lows, equivalent to an 85 dollar/yen, but is moving up on a key zone of resistance at 81.50-82.25.

Lots of factors lining up against the Japanese currency. Bloomberg BusinessWeek writes,

Japan’s status as an export superpower has taken a pummeling lately. First came news last month that the country had posted a $32 billion trade deficit for all of 2011, the first time that’s happened since 1980. Then, on Feb. 20, Tokyo announced a record shortfall for January of $18.5 billion, citing a strong yen that’s depressing exports and rising prices for energy imports. Japan may well record another yearly trade deficit in 2012. Now economists are worried that the nation’s current account could turn negative, raising questions about Japan’s ability to handle its $10 trillion-plus government debt load. That burden is equivalent to about 220 percent of Japan’s total annual economic output, the highest debt-to-gross domestic product ratio in the world. (That’s right: Greece’s debt level is a more manageable 164 percent of GDP.)

The government does want to see a weaker currency and no reason to panic until we see simultaneous moves of a falling currency, rising bond yields, and falling stocks.

Keep this one on your radar, folks.

Leave a Reply