Ryan Avent reports from Chicago on the willingness to believe the Fed is powerless to produce additional inflation:

Why is Mr Hall—why are so many economists—willing to conclude that the Fed is helpless rather than just excessively cautious? I don’t get it; it seems to me that very smart economists have all but concluded that the Fed’s unwillingness to allow inflation to rise is the primary cause of sustained, high unemployment. And yet…this is not the message resounding through macro sessions. Instead, there are interesting but perhaps irrelevant attempts to model the funny dynamics of a macro challenge that actually boils down to the political economy constraints (or intellectual constraints) facing the central bank. Let’s focus our attention on that, for heaven’s sake.

Avent is correct. It does seem that most economists believe that at the zero bound, allowing inflation expectations to rise is an effective – perhaps the only effective – mechanism for the central bank to accelerate activity. Moreover, if, as Avent says, we believe the Fed can prevent deflationary expectations, then they can certainly create inflationary expectations. The fact that they don’t would then be something of a mystery, as certainly we don’t see Federal Reserve Chairman Ben Bernanke as intellectually deficient on this issue. He can clearly do the math as well as anyone.

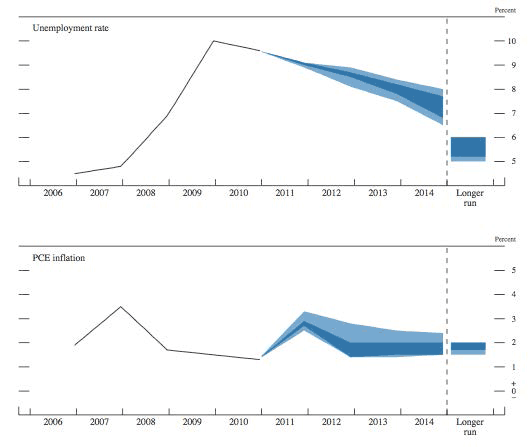

An answer to this conundrum is evident in the Fed’s forecasts (dark blue is the central tendency):

The disconnect between the unemployment and inflation forecasts is clear. The Fed has a dual mandate, and, according to its forecasts, it cannot meet both of the mandates in the near to medium terms under the expected policy path. So a choice needs to be made. And the Fed has chosen to focus on meeting the inflation side of the mandate (note, headline PCE inflation in the long-run, which is why I focused on that measure in a piece last week). No mystery. No reason for vast intellectual expenditures. Price stability means 2% inflation, and if we can’t meet the unemployment target within that mandate, so be it.

In other words, they are certainly capable of inducing higher inflation. They just don’t because, in their view, 2% is a firm target, and the costs of exceeding that target, or, more importantly, changing that target, are effectively assumed to be infinite and thus by definition exceed any expected benefits.

Now, you could argue, that it really isn’t this simple, since the “price stability” objective is not legally defined at 2% (Notice also that 2% is really the upper limit. On average, it appears that monetary policymakers would actually like something closer to 1.8%). There is a real question here that I don’t believe the Fed has adequately answered – why should the definition of price stability be 2% rather than 3%?

So what is the constraint – political, intellectual, or irrational – that forces the Fed to adopt a 2% inflation target, and then choose to act as if that target was written in stone? I imagine policymakers would respond to the first point by claiming that price stability really means zero percent inflation, and that they choose 2% because we overestimate inflation and need some cushion from the lower bound problem. Fine, but what if you are already in the liquidity trap? For the second part, they would argue that the economy would be less stable in the absence of a firm target. My reply is that this might be correct for the eight decades a century that you are not in a liquidity trap, but what about the other two decades you are in a liquidity trap? Is a target calibrated during normal economic conditions then supporting suboptimal outcomes in a liquidity trap?

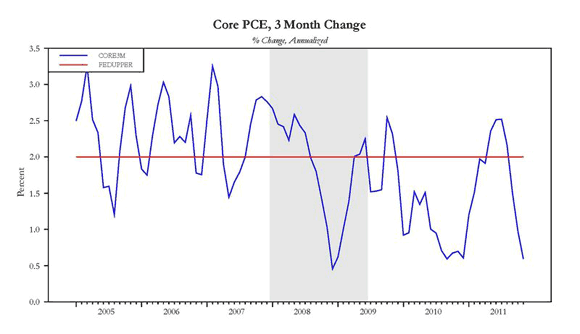

I expect to get some relief in at least the near term inflation forecasts at the conclusion of the next FOMC meeting, a decrease of the lower boundary of the central tendency which then helps clear the way for additional Fed easing. Core inflation has clearly been rapidly decelerating in recent months:

If you believe, as the Fed appears to, that core-inflation provides useful information on the direction of headline inflation, then the message is clear – headline inflation is likely to drift lower, and the economy needs more stimulus. What the Fed will deliver, however, will still be within the bounds of the 2% inflation target, and thus still falls short of the increase in expected inflation that the Fed should really be delivering.

Leave a Reply