Wind currents between the ocean and atmosphere affect climates around the world; likewise, government policy shifts and economic data have a similar ripple effect on markets.

During our Outlook 2012 webcast yesterday, our listeners heard a very passionate John Mauldin assess the debt situation in Europe, Japan and the U.S. and the need for immediate policy change. If you listened in, you may have wondered what economics and politics have to do with investments.

That’s a valid thought, as many investors hear predictions of which way the market will go or what stocks will outperform. As I often remind my readers, it’s not about political parties, it’s about the policies. And history says that government policy shifts can have a tremendous affect on the economy and the markets. While no one can predict the future, you can use probability in your favor.

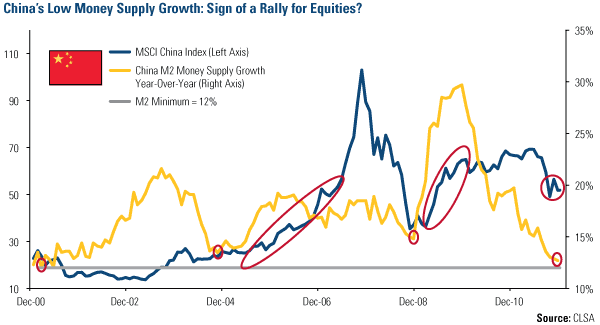

For example, Chinese stocks have historically moved with money supply. In the webcast, Analyst Xian Liang showed the chart below plotting the year-over-year money supply in China against domestic B-shares (represented by the MSCI China Index) since the end of 2000.

The Chinese government is known for acting decisively in making policy changes to steer its economy in the right direction. In 2009, the growth in money supply was at an 11-year high of 30 percent after the government lowered the required reserve ratio (RRR) for major banks. Adjusting the reserve requirement is important inflation-fighting tool in China’s monetary policy. The lower the reserve requirement, the more money banks are able to lend out.

Throughout 2011, due to concerns about inflation, China had been raising the reserve requirement for banks and interest rates. This action reduced money supply to the low we see in the chart. This December, China shifted its stance as slow growth became a risk and inflation slowed. This action should increase money supply, and encourage markets, going forward.

China also recently announced an earlier-than-expected windfall profit tax cut for its oil companies. This special oil income levy raises the level at which a barrel of oil is taxed, going from $40 to $55. This $15 difference essentially translates to a substantial tax break for oil companies and extra money in their coffers.

Research firm Jefferies expected the tax adjustment, but thought that it would happen at the end of 2012. With this tax cut, it appears the government acknowledges the need for Chinese upstream oil companies to increase their cash flow so that they can increase domestic production, says Jefferies.

This tax cut was closely followed by analysts, and was seen as a “big positive” for China’s oil companies, specifically CNOOC, PetroChina and Sinopec, says Citigroup Global Markets. The market promptly responded positively, with each stock rising on the news.

Another economic measure that has a ripple effect on global markets is the Purchasing Managers’ Index (PMI), an indicator of manufacturing strength. We follow this index closely, as it is considered a leading indicator, meaning the markets react over the following three months after the PMI data is released.

As of December 31, the JP Morgan Global Manufacturing Purchasing Managers’ Index (PMI) crossed above the three-month moving average. Going back to the inception of the index in 1998, there have been 20 occurrences when the one-month number crosses above the three-month. When this has happened, it’s signaled higher prices for many commodities, especially oil, copper, and to less of a degree, materials and energy.

For copper, historically, 90 percent of the time, the price was positive over the next three months, with a median return of 10 percent over the following three months.

During the same three months, 85 percent of the time, West Texas Intermediate oil has also gone up. Its median three-month change has been an increase of 11 percent.

Materials and energy were also positively affected, with modest results: When the PMI crosses above the three-month average, 70 percent of the time, the S&P 500 Materials Index rose, with a median return of about 3 percent. The S&P 500 Energy Index had a median three-month return of about 5 percent, with an 80 percent chance of the three-month change being positive.

We believe the winds are shifting to bring needed relief to global investors. We’ve seen improving economic data from the U.S. lately, and this positive news from the world’s largest economy, along with an improving China—the world’s most populated country—offsets the negativity in Europe.

Leave a Reply