Paul Krugman notes that the Eurozone crisis began rearing its ugly head again back in April, the very time the ECB decided to tighten monetary policy. Krugman thinks these two developments are probably related:

By itself, that rate hike — although it was obviously, obviously a big mistake — should not have mattered that much. But maybe it acted as a signal of the ECB’s bloody-mindedness, and that’s what set off the panic.

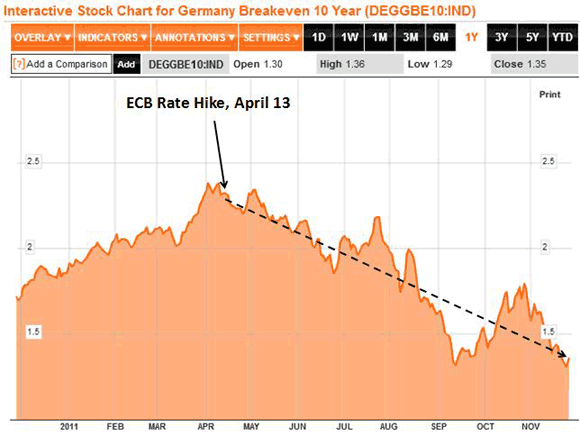

I agree. This market saw this interest rate hike as indicating the ECB would allow further weakening of Eurozone aggregate demand. Consequently, the market lowered its forecast of nominal spending and, as a result, expected inflation started declining, the Euro began weakening, and sovereign spreads started increasing. Here is the breakeven inflation for the Eurozone:

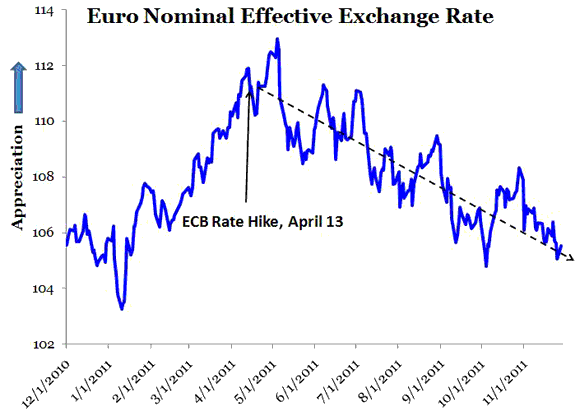

Here is the nominal effective exchange rate for the Euro:

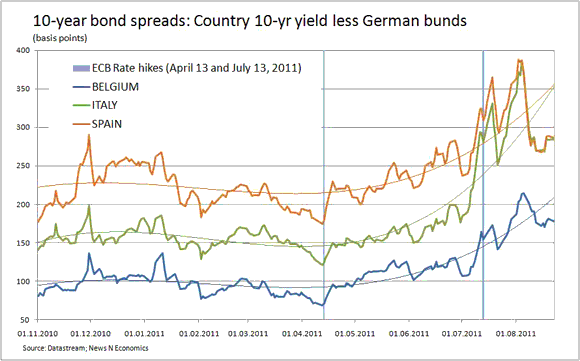

And finally, from Rebecca Wilder here are the surging spreads:

These figures show that these asset prices all took a marked change in trajectory at about the time the ECB tightened in April. All these asset price changes also have been indicating tight monetary policy since that time, but no one at the ECB seems to be listening. No one at the ECB seems to appreciate that by allowing aggregate demand to continue to weaken they are passively tightening monetary policy. The Europeans seem to be repeating monetary history.

Leave a Reply