The Congressional Budget Office reports are worth looking at as they often give clues on future economic policy and legislation. The CBO is supposed to be non-partisan. I’m not sure I understand what that means. In one way or another everything in D.C. is partisan. It has been my observation that the CBO attempts to steer the direction of policy in their reports. They push their own agenda. What motivates them is not clear to me.

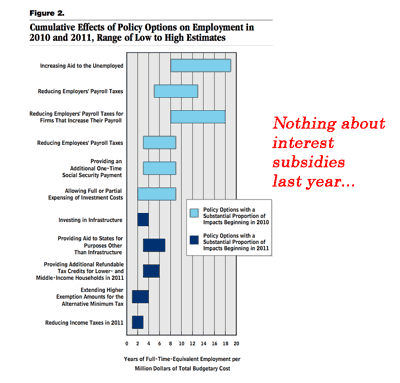

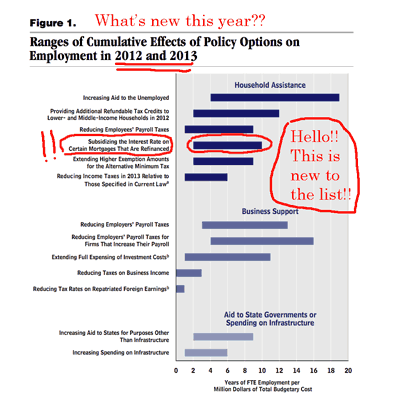

CBO recommends steps that could be taken. It also estimates the consequences of any economic policy action. They forecast (guess at) both the number of new jobs that would be created and for how long those jobs might last. The recent CBO report evaluates a range of stimulus options. The following two slides are from the 2/10 and the 11/11 reports. They are similar, but there is one very important new policy option in the most recent analysis:

(click to enlarge)

(click to enlarge)

The new thinking from the CBO:

“Subsidizing the Interest Rate on Certain Mortgages That Are Refinanced.”

The CBO is making a very strong suggestion that ON BUDGET mortgage relief should be considered as an economic stimulus. According to the CBO this new form of stimulus would be more effective in creating (lasting) jobs than (1) Infrastructure spending, (2) Increasing aid to individual states, (3) Corporate tax holiday on foreign earnings, (4) Reducing business taxes, (5) Expanding business depreciation (6) Sustaining the Bush tax cuts and (7) Reducing workers FICA taxes.

That’s incredible! Subsidizing mortgages with federal money is a better economic stimulus than infrastructure spending? We are charting new waters with this thinking.

The Federal Reserve has done everything feasible to reduce interest rates in an effort to create cheap refi opportunities. As a consequence, mortgage rates are at record lows. But the CBO thinks they have to be lower still and proposes to subsidize the rates consumers are paying.

I don’t agree with the philosophy of this new stimulus approach. It’s a kick the can down the road policy that is directed at a very small percentage of the population. The sand states would be the primary beneficiaries. The banks would also get another shot in the arm. I’m sick of policies that have imbedded subsidies to the financial sector.

That said, mortgage subsidies would be very popular with the politicians (from both sides of the aisle) in the coming election year. It is correct to view the US economy as currently running on only 6 of its 8 cylinders. The two that are misfiring are related to the housing sector. So a “fix” to the broken wheel that also gets votes is a theoretical possibility.

The fact that the CBO has teed up (and therefore legitimized) the idea of direct support for mortgage borrowers means that some of our lawmakers will come up with new legislation. In the current environment Washington can’t pass any legislation. So this has little chance of seeing the light of day. That said, the CBO is touting, a package that includes (a) extending unemployment benefits, (b) FICA cuts for employees and employers and (c) cash subsidies for mortgage borrowers.

The notion of oiling what squeaks makes sense at one level. On another level the idea that tax dollars should be used to directly reduce monthly mortgage payments would seem like the ultimate act of desperation. Are we really that desperate?

Leave a Reply