The debate between whether governments should focus on helping the economy grow faster or imposing discipline and austerity in their budgets is not going away. No one disagrees with the statement that governments needs to find ways to bring discipline to fiscal policy. Given current policies, governments are on an unsustainable path and there is a need for reform that will require a combination of lower spending and additional source of revenues.

The debate is on whether there is also a need to increase economic activity via expansionary fiscal policy (which in the short run is likely to make the deficit bigger). Not every country is in the same situation so it is difficult to provide an answer that is valid for every economy, but here are the two principles that should not be forgotten in this debate:

1. Bringing sustainability to public finances is about ensuring sound fiscal policy over the coming decades, not months. For many of the advanced economies, the future deficits look worse than the accumulated debt. Putting fiscal policy on a sustainable path requires reforms that should be long lasting, and we are talking about decades, not quarters. The difference between implementing these reforms in 2011 or 2013 is insignificant compared to the challenge that governments face. What matters is the commitment to get it right in the long run, not now. Yes, what governments do today could be a signal of what they will do over the coming decades, but this is only true up to a point. There will be new governments in the coming years and what is really required is not a contractionary budget one year but a structure and a set of constraints that ensures discipline for future governments.

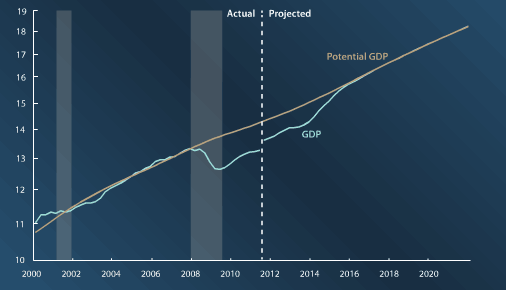

2. The need for additional fiscal stimulus is based on the assumption that we are not in a normal year. If unemployment was at a normal level, if the output gap was zero (output was equal to potential), then there is no reason to postpone the necessary adjustment. But there is a dimension of economic policy (both monetary and fiscal) that works towards the stabilization of the business cycle. We do not expect monetary policy or fiscal policy to be the same in a recession than in an expansion. And while fiscal policy might require to show discipline over the coming decades, the amount of discipline should be different depending on the phase of the business cycle. Letting the economy be producing below potential for a long number of years is not only socially costly but it leads to a permanent loss in output which is a potential source of tax revenues. And the most recent projections from the CBO (Congressional Budget Office) in the US show that GDP will be significantly below potential output for about 8 years, from 2008 to 2015 (see image below, source).

If we accumulate the output gap for all these years we are talking about a $5.1 Trillion gap that represents a permanent loss in output (and income, and tax revenues). Some might see this as a natural and unavoidable adjustment which almost amounts to claim that GDP and potential output are identical, the output gap is zero, unemployment is all structural. But given that the US economy has a strong tendency to return to its trend regardless of economic shocks, it is difficult to argue that there is no output gap to be filled in 2011 (or any other year before we get to 2015).

Leave a Reply