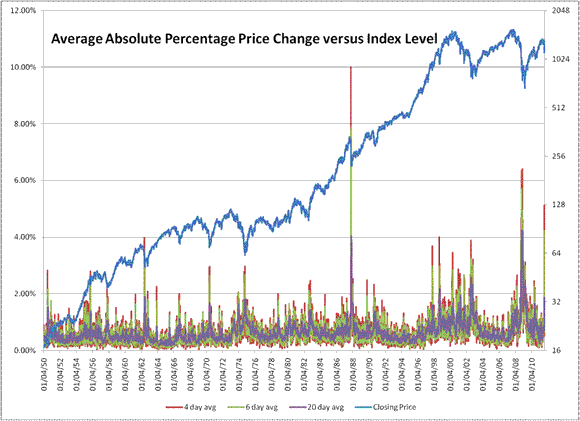

The graph above is the S&P 500 on the right axis with a logarithmic scale, and 4-, 6- and 20-day average absolute percentage price change on the the left axis, linear scale. As you can see, high price volatility is associated with bear market bottoms.

In terms of 4- and 6-day volatility, this market ranks third in the last 61 years, behind 1987 and 2008. Wait another three weeks for the 20-day volatility, it could be competitive with 2008 and 1987. 1987 was sharper and shorter than 2008 because there weren’t any systemic risk issues involved, as there are in 2008 and 2011.

Isn’t it fascinating that the volatility level is so high now — what makes this period of time so special compared to the overvaluations of 1987 or the overleverage of 2008? I think it is overleverage again, though valuations are somewhat high.

Leave a Reply