Smart Money

Back on 10/14/2010 I wrote an article titled, “We’ll Never See Dow 10,000 Again”. It was about a guy I know who invests other people’s money for a living. The fellow made the crack about DOW 10k (not me). He was right for a while. But he is long and wrong today.

I bring this up for a reason. In the week before the debt ceiling deal about 99% of Wall Street was convinced there would be a last minute deal. They were also convinced that a big stock rally would be the end result. I heard it from the folks I talk to. We all heard it on the TV.

Last week’s “Sell on the news” reaction was a consequence of Uber-enthusiasm going into the “Ceiling Deal”. Today’s crap out is a consequence of S&P. I watched more TV today. I listened to all the smart guys I know on WS. They all had the same view; “Buy of a life time!”

Wall Street only understands earnings and top line sales. WS has no clue that what is driving equities the past few weeks has nothing to do with equities. It appears that the public sector finances of governments around the world are imploding at the moment. It doesn’t matter if APPL is trading at (only) 8Xs forward earnings. Not if governments are on fire.

I have no clue what happens next. I’m pretty sure that the “Pro” investors on Wall Street are still long, and yes, wrong. Usually that means we have lower to go. After all, those Smart Guys are not so smart in the end.

Big Downgrade

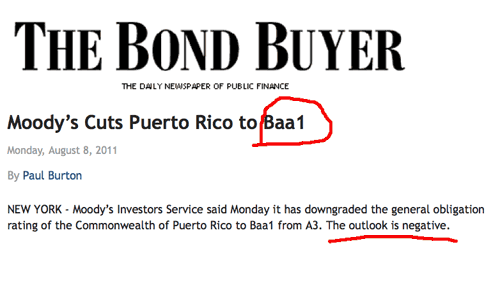

No, not the USA; Puerto Rico. Moody’s dropped PR to B status.

I went looking for the External Debt report for PR. I found it no problem at all. But I was very surprised to see that the information was only available in Spanish. Interesting for the 51st State. Also interesting in that the vast majority of that debt is in US bond funds and 401’s.

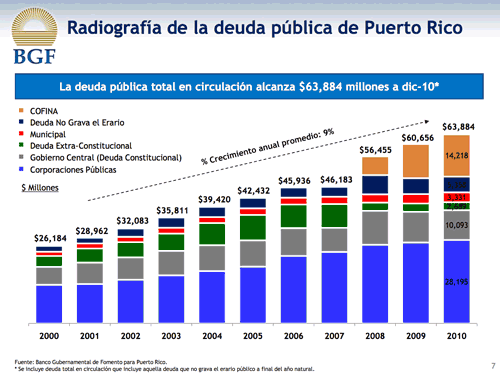

This chart tells the story even if you don’t read Spanish. The bottom line is that PR had a very lumpy $64 B of debt on the books as of the end of 2010.

Could PR be a monster puke in the Munis market? Yup.

Watch the Swiss

The EU went to the next level today with bond purchases in the five-year area for both Spain and Italy. A very major escalation. The problem with ramping up the stakes is that there can be no certainty that the ECB will prevail. They put on a good show today. But is this a one trick pony?

In spite of the big bond market intervention the CHF hit a new high against the Euro. This market barometer shouted out; “It’s a one tricker!!”

The Swiss are pretty much at their rope’s end with the ever-stronger Franc. A week ago they cut deposit rates for foreign money to zero. That did nothing to stem the tide. The only remaining option is direct intervention. Given that the ECB is actively intervening in the bond markets, it’s not impossible that the Swiss National Bank will show its hand in the currency market sometime this week. Just one big happy party of interveners.

The SNB did this a year ago and got crushed. They have tens of billions of Francs in losses on their books. This one year chart says it all:

I’m Swiss. I like to think I understand a bit of the Swiss psyche. They love to double down.

Seat belts on.

Leave a Reply