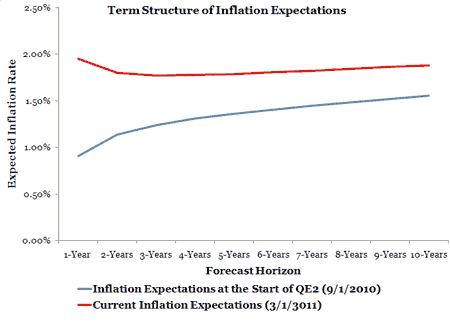

Ryan Avent is right that we should not get worked up over the possibility that U.S. core inflation appears to have bottomed out. A potential turn around in core inflation does not negate that fact that the demand for money remains elevated and is hampering a robust recovery in nominal spending. In addition, forward-looking measures of inflation indicate that long-term inflation expectations remain below the Fed’s implicit 2% inflation target as seen in the figure below:

Source: Cleveland Fed

Between the elevated demand for money and below-target inflation expectations, it is hard to see why one should get excited about the recent activity in core inflation. These developments, if anything, indicate that monetary policy may still be too tight.

Leave a Reply