Ryan Avent responding to Brad DeLong’s interpretation of the most recent FOMC statement, comes down easy on the Fed:

…a strict reading of the Fed statement suggests that the central bank is planning to keep rates low because the economy is likely to remain weak. In that case, the rate forecast wouldn’t be expected to raise inflation and wouldn’t be stimulative. I shy away from the strict interpretation of the statement, because it would make no sense to add the language in the first place if that’s what the Fed were actually saying. Perhaps too charitably, I lean toward a view that the Fed is trying to raise inflation expectations without spooking its critics, internal and external.

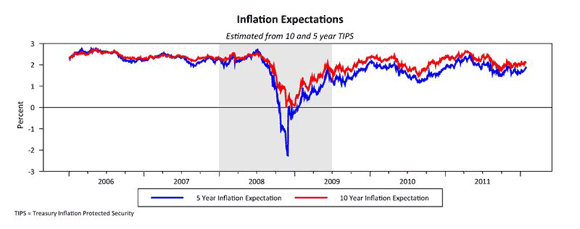

Fair enough, I see that. But what has been nagging at the back of my mind is the decline in TIPS measured inflation expectations since the recession:

Of course, these are not perfect measures of inflation expectations, but they still tell an interesting story. Consider that in 2006 and 2007, the average five and ten year inflation expectations were 2.38% and 2.41%, respectively. Since 2010, the averages are 1.80% and 2.14%. A reasonably sharp 58bp decline at the five year horizon, and a smaller 27bp decline at the ten year horizon. So, at first blush, if the Fed is trying to raise inflation expectations to the pre-recession rates, they have not been particularly successful, especially in the near term.

The interesting question, however, is does the Fed want to return inflation expectations to the pre-recession rates? The transfer from TIPS inflation expectations to Fed policy is not perfectly smooth. TIPS returns depend on the CPI; the Fed targets the PCE price index. So instead of focusing on the level of TIPS inflation expectations, consider the roughly 30bp decline in the ten-year horizon. Presumably, the longer-run fits better with the Fed’s objectives. And we know the target is 2%, courtesy of the explicit policy statement released at the last FOMC meeting.

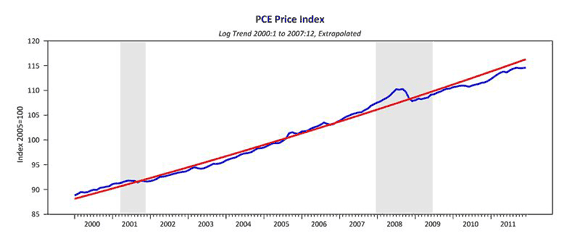

Now consider the pre-recession headline PCE price index trend. What should be the beginning of sample? Honestly, I don’t know. But for convenience, let’s consider the period from 2000:1 through 2007:12, which should be long enough to form reasonable inflation expectations, and extrapolate that trend forward:

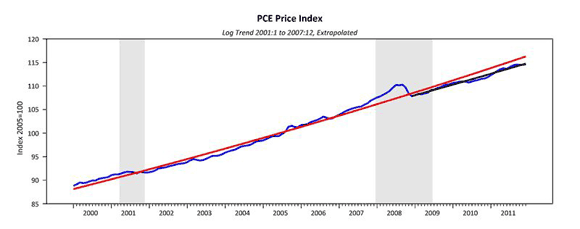

The PCE price index is currently tracking below that trend, which would seem to open the door to more aggressive policy. But that trend represents inflation running at 2.3%, about 30bp above the Fed’s target. Now fast forward 12 months and consider the trend since 2008:12:

That trend line represents a rate of inflation of just a bit above 2%, right in line with the Fed’s target. And 30bp less than the pre-recession trend. Or about the same as the 30bp decline in the ten-year TIPS inflation expectation.

You see where I am going with this. The Fed was facing something higher than 2% inflation prior to the recession. Now they are looking at 2% inflation, which is also now the official target. It seems to me they might have used the recession to bring down the path of prices and along with it inflation expectations – something that might surprise the Fed’s critics from both sides of the aisle.

Leave a Reply