A “proper” subsidy?

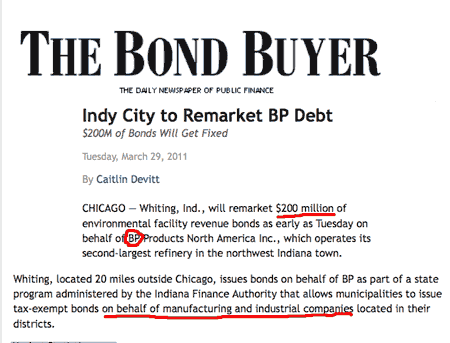

What’s the proper function of the Muni bond market? Keep in mind that this is not ‘free money’ we are talking about. Munis are tax-free. So there is always a subsidy attached to their issuance. Building a new bridge or highway has benefits for the public. Financing school construction and all manner water/sewer projects also benefits the public. There are dozens of examples I could give where the tax subsidy is justified as it creates a greater common good. But not this one:

It’s over (QE that is)

All of the Fed talk of late points in one direction. There will be no QE3 after 6/30/2011. We have not heard from Bernanke on this. I doubt we will. But I do expect that either the WSJ, NYT or WAPO will have an article in the next week or so that has the Chairman’s words embedded in the story. That article will be the point in history were the QE experiment actually dies.

We will still have QE1-Lite. This is the re-investment of principal from MBS holdings. Given that interest rates have risen significantly the prepay speed of the MBS is going to slow to a trickle. Future POMO operation will be in the $10-15b monthly range. They will have little to no impact.

The question in my mind is will we see a reversal of the QE consequence to the big markets? Is the private sector economy able to operate successfully without $100b a month in POMO? We are about to find out.

IMHO the Fed should have started the process of regularizing credit costs a year ago. They should never have done QE2. If that had been the case we would not have seen the big jump in equities. Inflation would be somewhat tamer. But they chose instead to step on the gas at precisely the wrong moment. Bernanke got spooked by bad numbers in the summer. He made a bad choice and when he got pregnant with QE2 nine months ago he got stuck with the policy. To have changed direction at midstream would have meant that Ben would have to acknowledge the mistake. Not likely. With the benefit of hindsight even he would (privately) admit to that today.

But now we have to (again) go through withdrawal of a short-term sugar high. That has always been messy in the past. Uncertainty (AKA: Volatility) is going to have to rise as a result. Fast markets are coming.

Rumors of News?

I wish I were at this “friendly” chat. Look for this to be the “Big Fix” to the mortgage foreclosure crisis. The big banks will yell and scream at all the proposals. In the end this will cost them at least $20b. But they will love the results.

Remember the Uncle Remus story of the rabbit who begs to be thrown in the briar patch?

Brer Rabbit shuddered. “Hanging is a terrible way to die! Just terrible! But I thank you for being so considerate. Hanging is better than being thrown in the briar patch.

Scratch out my eyeballs! Tear out my ears by the roots! Cut off my legs! Do what’nsoever you want to do with me, Brer Fox, but please, please, please! Don’t throw me in that briar patch!”

We know how that story ended….

Speaking of briar patches, getting eyeballs torn out, and having legs and arms hacked off, how about that Wal-Mart (WMT) – Supremes story that is due out today?

The shares are $52. I think that is a neutral price. Meaning the market does not know how to handicap this massive lawsuit. It should break one way or the other. It should do it by the close. My bet? The Supremes fold 5 to 4. There will be no class action law suit against the company that “America Loves” (to hate).

Leave a Reply