Why is gold (and select commodities) dropping right now when anyone in their sane mind would expect it to rise? Because the Fed may reverse its monetary policy faster than once thought.

The Federal Reserve should hike interest rates from current range near zero to 2.5% within a year under a plan unveiled Friday by Charles Plosser, the president of the Philadelphia Federal Reserve Bank.

From MW: “In a speech to economists from the monetarist school on Friday, Plosser laid out an aggressive plan where the Fed would sell $125 billion of assets for each 25 basis point increase in the funds rate.

A slower approach could last 18 months rather than a year, Plosser said. “This would require only $67 billion of conditional sales between meetings but the funds rate would rise to 3.5%.”

Plosser, a voting FOMC member this year, said he did not think this strategy would negatively affect markets.

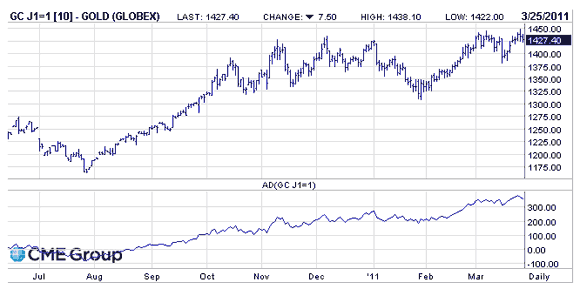

April gold finished the session lower by $8.60 to $1426.30 an ounce. Silver finished down too, to end at $37.18.

Leave a Reply