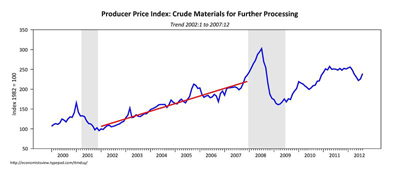

If QE causes commodity price inflation, what caused commodity prices to rise before QE? It never ceases to amaze me that critics of quantitative easing fail to remember that commodity prices were rising well before the Federal Reserve engaged in quantitative easing:

(click to enlarge)

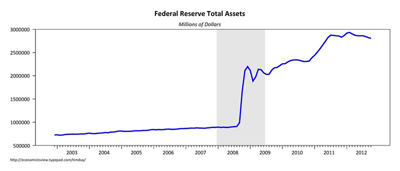

If anything, commodity prices have been moving generally sideways since the Fed began expanding its balance sheet:

(click to enlarge)

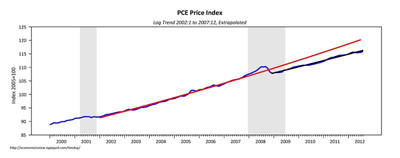

And please don’t say “commodity prices have surged since the beginning of 2009.” I think it is pretty obvious that virtually everyone would not want to return to the economic conditions of 2009 to achieve lower commodity prices. The rebound of commodity prices was a natural consequence of expanding global activity; if QE is to blame, it must also be blamed for the economic rebound. Also, why have headline consumer prices grown more slowly since the Fed initiated quantitative easing?

(click to enlarge)

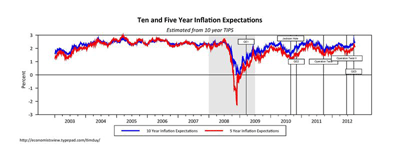

What about the surging inflation expectations in the TIPS markets (not necessarily the best measures of inflation expectations, and the ones already falling anyway)?

(click to enlarge)

At best, quantitative easing is keeping inflation expectations propped up, barely. And once again, does anyone really want to return to the collapsing inflation expectations at the height of the recession? And are expectations any higher than before quantitative easing? No.

Bottom Line: If anything, inflation is lower, both for commodity prices and headline PCE, after quantitative easing. So isn’t it finally time to put to rest the myth that quantitative easing is causing runaway inflation? Nothing to see here folks, move along.

Only price increases generated by DEMAND, irrespective of changes in SUPPLY, provide evidence of inflation. There must be an increase in aggregate demand which can come about only as a consequence of an increase in the volume and/or transactions velocity of money. The volume of domestic money flows must expand sufficiently to push prices up, irrespective of the volume of financial transactions, the exchange value of the U.S. dollar, and the flow of goods and services into the market economy.