The Federal Reserve did as expected, leaving policy unchanged. But policymakers tweaked the statement ever to slightly to suggest that indicators are at a minimum not moving away from the objectives of the dual mandate – a critical first step on the road toward normalizing monetary policy.

First, apparently there was some surprise that the Federal Reserve failed to mention the unfolding crisis in Japan. From the Wall Street Journal:

Federal Reserve policy statements are supposed to outline the forces that will drive monetary policy over coming months, so while it wasn’t unexpected, it’s nevertheless puzzling central bankers omitted the biggest risk of all: Japan.

I suspect they did not mention Japan because little information is known about the economic risk or they don’t perceive it to be the primary risk in the US outlook. Indeed, we have been down this road before with Hurricane Katrina – even very large disasters in advanced economies appear to have limited overall economic impact, although the regional impacts could be quite severe. I often wonder if economists have a tendency to initially overestimate the potential impact of such events as they believe the economic impacts must somehow reflect the human impact, or that if they don’t play up the economic impacts they will be seen as downplaying the human impact. I tend to be less concerned about the economic impact (particularly over the longer term; market economies have proven to be remarkably resilient) and instead am much, much more concerned about the very devastating and long-lasting human impact of this tragedy. I recommend the guest post at Econbrowser on this topic. To be sure, policymakers will be watching this and other situations closely, but I suspect they would turn to this kind of research as a guide and conclude for now that the global economic impact will be largely transitory.

Indeed, instead of focusing on the downside risk, policymakers turned their attention largely to on the moderately positive news. First, as has been widely noted, the Fed upgraded the economic assessment – the recovery is not only on “firmer footing,” but labor markets “appear to be gradually improving.” The last bit is important. The lack of any meaningful improvement in labor markets has been a central feature of this recovery, and a major impediment to any change in policy. Signs of improving labor conditions are a welcome relief for policymakers.

Note also that the language regarding commodity prices is focused on the inflationary, not deflationary, implications. I tend to believe the Fed would ultimately be forced to ease policy further in the event of a significant oil price surge, but there is no indication here that this is the concern.

Furthermore, notice the slight change in the language regarding the inflation trend. The Wall Street Journal missed it:

The language on its closely watched measures — core inflation and expectations — is unchanged. The bottom line here is that policy makers aren’t overly concerned about inflation right now.

True, they are not overly worried about inflation. But Calculated Risk spots the small but important change:

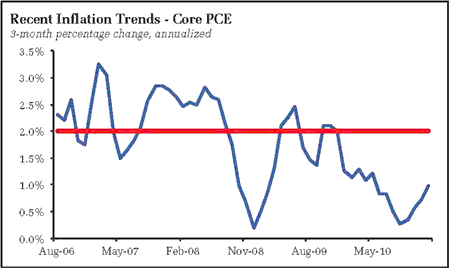

Inflation “subdued” instead of “trending downward”

If you are looking for QE3, you need some combination of ongoing labor market stagnation and threat of deflation (the two go hand in hand). Instead, what the Fed sees is improving labor markets and inflation that appears to have hit a floor:

Of course, despite indications data is actually heading in the direction of the dual mandate, the size of the output gap, high unemployment, and weak wage growth all argue against tightening policy in any way, shape, or form. Hence the current large scale asset program continues unabated. I still believe the calendar argues against any deviation from this plan. Even if incoming data strongly surprised on the upside, by the time the Fed was able to assess such data and act, the policy would be nearly at an end. Changes would be essentially pointless.

Bottom Line: Monetary policy continues on autopilot – they still plan that QE2 will end as expected at which time policymakers will turn their attention to policy normalization, setting the stage for a rate hike in 2012. Watch for signs that the downside risks (oil, Japan, Europe, etc.) are evolving in such a way that they are impacting actual data, with the weak reading on consumer confidence being a cautionary tale. But if the data holds up, with steadily improving labor markets and improving inflation measures, the next test for monetary policy will be the end of QE2. Will markets falter in the absence of a steady drip of monetary policy?

Leave a Reply