Manitowoc Co. Inc. (MTW) continues to build upward momentum to fresh 8-month highs over $16, with today’s strength being attributed to the co.’s Q4 earnings release. MTW, which today posted the biggest gain in the Russell 1000 Index, reported last night adjusted fourth-quarter earnings excluding some items of 11 cents per share, on sales of $830.9 million. Analysts were expecting a profit of 4 cents per share on revenue of $852.8 million.

“Exceptionally strong order rates toward the end of the fourth quarter drove year-over-year and sequential sales growth for our Crane segment. North America and Europe are beginning to show signs of modest recovery, and we’re encouraged by new orders from dealers that are beginning to replenish their inventories,” the company said in a prepared statement.

The maker of overhead cranes also said that it expects crane revenue year-over-year growth in the low double-digits, while crane margins should improve building off fiscal 2010 trough levels. Fourth-quarter 2010 net sales in the crane segment came in at $491.4 million, up 2.3% from $480.3 million in the fourth quarter of 2009, and up 12.0% from third-quarter 2010 sales of $438.8 million.

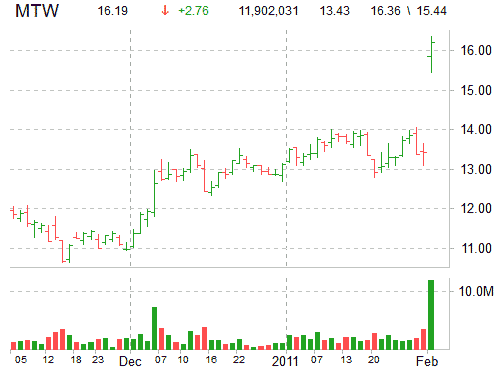

Technically speaking, MTW has gapped sharply above former short-term resistance at the $14 level. Buyers however, need to step up and support the issue here in the $16 area for the stock to be able to make higher-highs and re-print in the process its April 26, 2010 – 52-week high of $16.43. At this point all of the action following today’s high volume breakout looks to be entirely consolidative in nature. Having said that, we have to keep in mind that while the squeeze setup is still in play here – the $16 level has been a considerable hurdle for MTW. During the last year MTW has seen a few dips down off the highs and all of them were sold.

Shares of Manitowoc are currently up 20.36% at $16.20. Volume has exploded with more than 11.8 million MTW shares already trading hands compared to a daily average volume of 2 million shares. The day’s trading range for the ticker has been between $15.44 and $16.36 per share.

The median Wall Street price target on the security, which currently trades at a forward multiple of 26.16 and a P/E to Growth ratio of 15.75, is $14.00 with a high target of $16.00.

MTW has a market cap of $2.13B and a 50-day moving average of $12.91.

Author holds long MTW position

Leave a Reply