Like Paul Krugman, I have little or no pity for the Banksters who are demanding that the rest of us stop saying nasty (and true) things about them. Unlike Paul Krugman, I believe that interest rates should be permitted to rise — if that is where the market says they should be.

Krugman claims that Banksters believe that low interest rates are “feeding inflation,” something he claims is not true. Yes, oil prices are rising, and so are gold and other commodities, but Krugman has an explanation for that: natural volatility and “emerging markets.” (He also appeals to the same excuse that the Soviets used to explain decades of bad harvests: bad weather.)

Here is the problem: interest rates should not be decided politically. According to Krugman, any raising of rates will trigger a new bout of unemployment, and at one level he is correct. However, the artificially low interest rates that Krugman endorses are having the perverse effect of preventing the necessary relocations in the economy that will bring about a recovery. Explains Bob Murphy:

…at some point reality rears its ugly head. The central bank hasn’t created more resources simply by buying assets and lowering interest rates. It is physically impossible for the economy to continue cranking out the higher volume of consumption goods as well as the increased output of capital goods. Eventually something has to give. The reckoning will come sooner rather than later if rising asset or even consumer prices makes the central bank reverse course and jack up interest rates. But even if the central bank keeps rates permanently down, eventually the physical realities will manifest themselves and the economy will suffer a crash.

During the bust phase, entrepreneurs will reevaluate the situation. If the government and central bank don’t interfere, prices will give accurate signals about which enterprises should be salvaged and which should be scrapped. Those workers who are in unsustainable lines will be laid off. It will take time for them to search through the developing opportunities and find a niche that is suitable for their skills and is sustainable in the new economy.

During this period of reevaluation and search, the measured unemployment rate will be unusually high. It’s not that workers are “idle,” or that their productivity has suddenly dropped to zero; rather, it’s that they need to be reallocated, and that takes time in a complex, modern economy. This delay can be due to simple search, where the workers have to look around to find the best spot that is already “out there,” or it can be due to the fact that they have to wait on other workers to “get things ready” before the unemployed workers can resume.

Since Krugman holds that factors of production (for analytical purposes) are homogeneous, then raising interest rates makes no sense, as all that needs to happen is for government to stimulate more spending, which then will automatically translate to producers ramping up their productions lines, and all soon will be well. If this were the case — and it did not matter where capital investments were made — then Krugman would be correct.

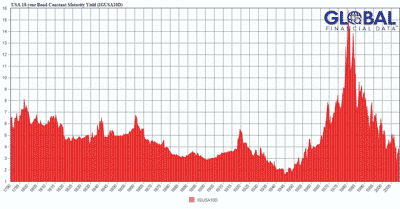

However, if factors from labor to capital ARE heterogeneous, and that the value relationship between those factors matters, then Krugman actually is fighting against the very necessary economic readjustments that are needed to create a meaningful recovery. Furthermore, we forget that this country had an economic recovery — a substantial recovery — in the 1980s even though interest rates were substantially higher than they are now. The image below demonstrates my point:

(click to enlarge)

Now, it is true that interest rates fell during the recovery, but they still remained in double-digits through much of the 1980s when the economy was going strong. Unfortunately, because Krugman continues to stick to his “aggregate demand” thesis, all of this to him is white noise.

As I see it, the issue is not whether the government or central bank or anyone else should decide if interest rates rise or fall. I want to know what the market says about rates of interest, and I cannot help but believe that with the Fed trying to flood the world with dollars, that they are going to go up sooner rather than later. But they will rise.

Leave a Reply